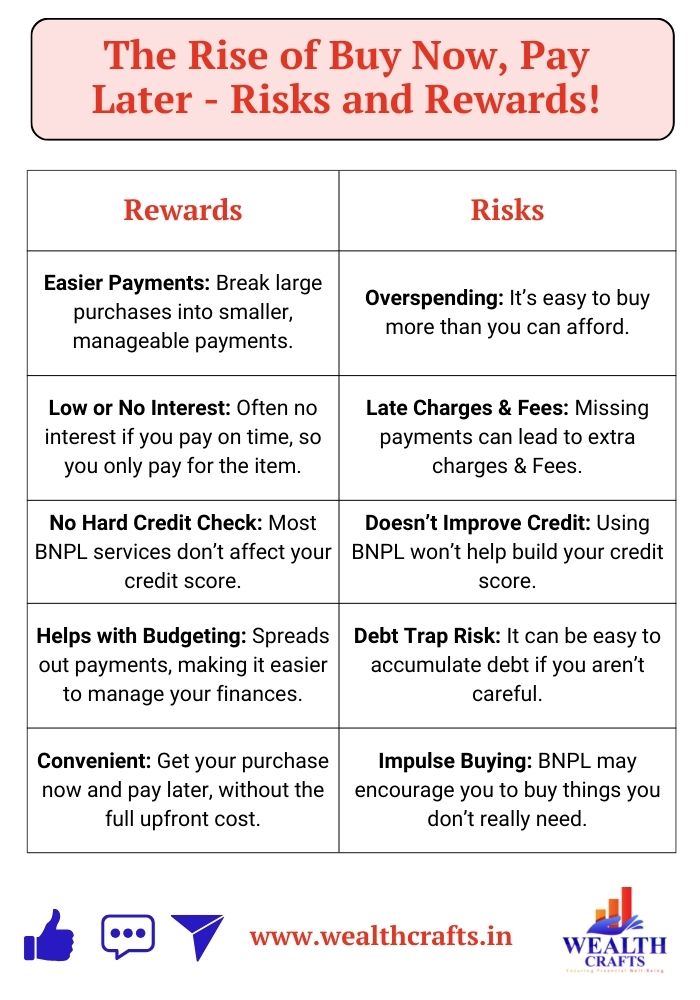

In recent years, the “Buy Now Pay Later” (BNPL) option has gained significant popularity. It allows consumers to make purchases immediately and spread the payments over weeks or months. For many, the convenience and flexibility of BNPL can feel like a game changer. However, like any financial tool, BNPL comes with both risks and rewards.

Let us now explore a few of the risks and rewards associated with Buy Now, Pay Later options.

What is Buy Now Pay Later?

Buy Now Pay Later (BNPL) is a short-term financing option that allows consumers to make purchases and pay for them over time, typically in instalments. It’s like a mini-loan that lets you buy something now and spread the cost over a few weeks or months.

Here’s how it generally works:

You make a purchase Choose Buy Now Pay Later as your payment method at checkout, either online or at participating physical retailers.

You pay a portion upfront Depending on the provider, you might pay a small portion of the total cost upfront.

You make instalments The remaining balance is divided into smaller, manageable payments over a set period, often interest-free if paid on time.

BNPL offers the benefit of getting your purchase immediately without having to pay the full amount upfront. The convenience of paying in instalments, especially without interest (if payments are made on time), can be very appealing. However, while Buy Now Pay Later seems like an easy solution, it’s important to remember that it comes with rewards & risks, so it’s essential to understand them before committing.

The Rewards of Buy Now Pay Later

Increased Purchasing Power

Imagine this you’ve been eyeing that new laptop for months, but it’s a big investment. With Buy Now Pay Later, you can get it now and spread the cost over several weeks or months. This is especially helpful for big-ticket items like electronics, furniture etc. It allows you to make those important purchases without having to save up for months or years.

Interest-Free Payments

Unlike credit cards, which often accrue high interest charges on unpaid balances, many Buy Now Pay Later services offer interest-free plans. This means you pay only the price of the item, without the added burden of high-interest charges. By avoiding these extra charges, Buy Now Pay Later can be a more budget-friendly option for consumers looking to make larger purchases without the financial strain of interest & debt.

However, it’s important to note that longer repayment tenures can lead to higher interest costs. So, when choosing a BNPL plan, it’s often better to opt for a shorter repayment period to avoid extra charges.

Easy and Quick Approval

BNPL services offer fast and straightforward approval, typically requiring only a soft credit check, which doesn’t impact your credit score. This ease of access makes Buy Now Pay Later popular, particularly among younger individuals or those with less-than-perfect credit who might not qualify for traditional loans or credit cards.

However, it’s important to note that Buy Now Pay Later may not be available for individuals with low credit scores in many cases. While the approval process is quick, having a poor credit history can limit your access to these services.

Budgeting and Flexibility

Buy Now Pay Later’s instalment payment option helps to manage budget more easily. Paying overtime makes it simpler to handle expenses, especially during busy shopping seasons or when budget is tight. It gives you more flexibility to plan your finances without the pressure of paying everything upfront.

The Risks of Buy Now, Pay Later

Debt Accumulation and Impulse Spending

While Buy Now Pay Later (BNPL) offers flexibility, it can lead to overspending and impulse purchases. The ease of making payments in instalments may tempt you to buy more than you can afford. For example, you buy a new smartphone with BNPL, then a week later, see a pair of cool sneakers and make another BNPL purchase. Now, you have multiple BNPL payments to keep track of, each with its own due date. With multiple purchases across different services, it’s easy to lose track of what you owe, and missing payments can result in late fees or interest charges. This quickly turns what seemed like a convenient option into a financial burden, putting significant strain on your budget and causing stress over how to manage multiple payments.

Late Fees and Interest Charges

While many Buy Now Pay Later services offer interest-free periods, missing a payment can turn a good deal into a costly one. Late fees, which vary by provider, can add up with every missed installment. Some providers may even increase the amount you owe if payments are missed. On top of that, interest charges can kick in, making what seemed like an affordable option much more expensive.

Credit Score Impact

Don’t let missed payments derail your credit score, While Buy Now Pay Later services generally avoid hard credit checks, failing to keep up with those instalments can seriously impact your creditworthiness. Some providers report missed payments to credit bureaus, potentially damaging your credit score and making it harder to get approved for loans or credit cards in the future.

Lack of Customer Support

Unlike traditional credit cards with their strong customer support, Buy Now Pay Later services might not always have your back, making it feel like navigating a maze to resolve issues like receiving a damaged or defective product, as some providers may not offer the same robust dispute resolution processes, leaving you with fewer options to get your money back.

How to Use Buy Now, Pay Later Responsibly

BNPL can be a handy tool, but like any financial tool, it’s important to use it wisely to avoid getting into trouble. Here’s how to make the most of it:

Know Your Limits

Before you click “Buy Now,” take a hard look at your budget. Can you comfortably afford the instalment payments without stretching yourself too thin? Make sure you’re not piling on too much debt by keeping track of other bills and existing loans.

A simple but important step: Do I have enough liquid assets (cash or easily accessible savings) to make the full payment if needed? If you can afford the full payment now without affecting your financial security, then it may be okay to proceed.

If the answer is no, it’s best to skip the purchase and rethink. Avoid overextending yourself to maintain control over your finances.

Be On Time, Every Time

Missing a payment can quickly turn that “interest-free” deal into a costly mistake. Late fees can add up fast, so set reminders or even automate your payments to avoid any surprises.

Don’t Get Carried Away

It’s easy to get caught up in the convenience of BNPL, but it’s important to stay in control. Try to limit how often you use it and how many different BNPL services you sign up for. This will help you keep track of your spending and avoid taking on too much debt.

A good rule to follow is the 40-45-15 budget:

- 40% of your income should go to essential expenses (like rent, bills, and groceries).

- 45% should be saved or used for your future goals.

- 15% can be for discretionary spending (things you want, like dining out or entertainment).

When using BNPL, make sure your EMI payments don’t exceed 25% of your income. This helps you stay balanced and avoid over-spending.

Read the Terms & Conditions Before you hit “confirm,” take a moment to read the terms and conditions carefully. Some providers may charge interest or fees after the initial interest-free period ends. Understanding these terms will help you avoid unexpected costs and stay in control of your finances.

By using BNPL responsibly, you can enjoy its benefits while keeping your finances in healthy and minimizing the risks.

Ready to make the most of Buy Now Pay Later while staying on top of your finances? We can help you navigate the benefits and risks of BNPL and create a plan that works for your budget. Schedule a free consultation calls today and take the first step toward smarter financial decisions!