Ravi, a 45-year-old software engineer, recently realized the urgency of retirement planning. Caught up in the cycle of meeting daily expenses buying a house and educating his two children– he had neglected to prioritize retirement savings. Now, with his children nearing adulthood and his career approaching its peak, he feels the weight of a late start.

Ravi understands that starting late means he’ll need to invest more aggressively to achieve his retirement goals. He consulted with a financial planner who helped him assess his current financial situation, understand his retirement needs, and develop a personalized plan.

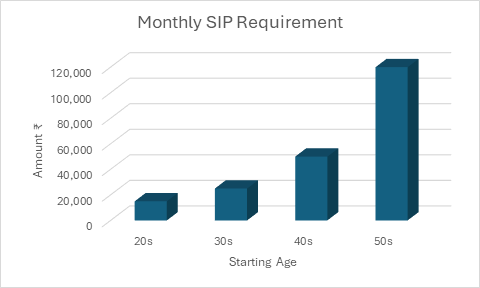

The Power of Compounding and the Cost of Delay:

Ravi’s financial planner emphasizes the significant impact of starting early, highlighting the power of compounding.

Considerations:

- Monthly Expenses: ₹50,000

- Annual income Growth Rate : 5%

- Life Expectancy: 90 years

- Inflation: 5%

- Retirement Age: 60 years

- Pre-Retirement Annual Return: 10%

- Post-Retirement Annual Return: 7%

The table below illustrates the approximate monthly SIP requirements at various life stages, demonstrating the increasing burden of delayed investment:

| Starting Age | Step up Monthly SIP Contribution Growing @5% P.a | Advisor Comments |

| 20s | 15,000 | Benefits significantly from long-term compounding |

| 30s | 25,000 | Requires higher contributions to compensate for a shorter investment horizon |

| 40s | 50,000 | Significantly higher contributions are needed to achieve retirement goals |

| 50s | 1,20,000 | Requires substantial contributions and potentially aggressive investment strategies |

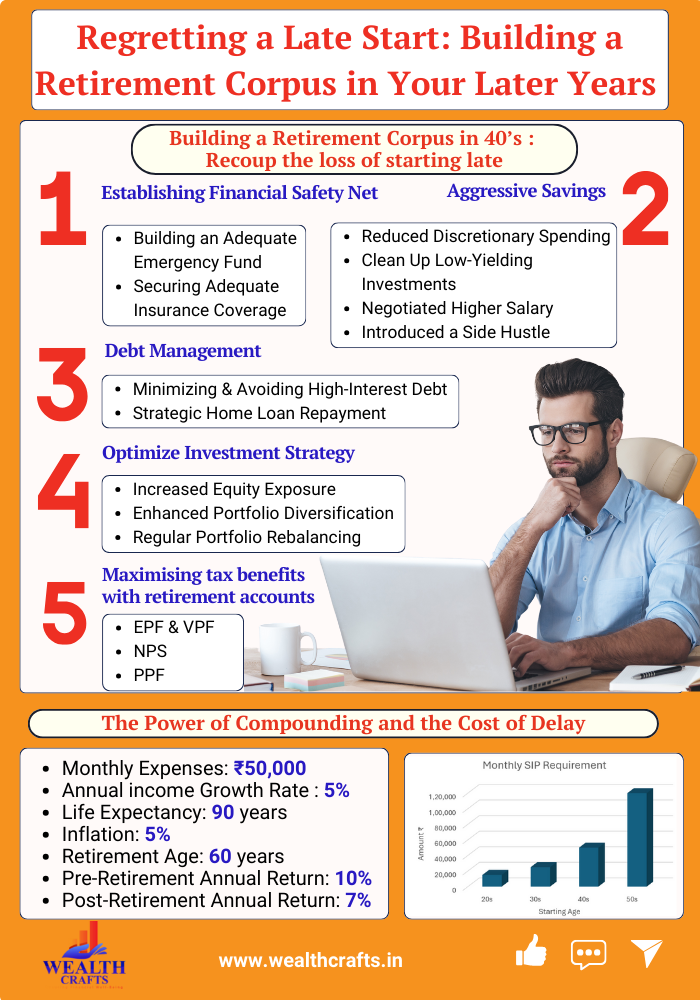

Building Retirement Savings Corpus in 40’s : Recoup the loss of starting late

Starting late on retirement planning can feel daunting, but it’s not impossible to catch up. Here are some strategies Mr. Ravi considered with the help of financial planner for building adequate retirement savings.

1. Establishing Financial Safety Net:

Before embarking on any investment journey, it’s crucial to establish a strong financial safety net to withstand unforeseen life events. This involves:

- Building an Adequate Emergency Fund: An emergency fund is a readily accessible pool of cash that can be used to cover unexpected expenses such as medical emergencies, job losses, or unforeseen repairs. Mr. Ravi established a 6 months of living expenses as emergency Fund readily available in a liquid account like a savings account or a short-term liquid fund. Refer our blog to know more about emergency fund.

- Securing Adequate Insurance Coverage:

- Term Insurance: Term insurance provides life coverage for a specific period, ensuring financial security for your dependents in the event of untimely demise. With the guidance of his financial planner, Mr. Ravi assessed his insurance needs and determined the appropriate level of term insurance coverage to adequately protect his family in his absence.

- Health Insurance: Mr. Ravi initially relied solely on his company-provided health insurance. However, after consulting with a financial planner, he recognized the critical importance of having comprehensive independent health insurance. This realization stemmed from the understanding that relying solely on company-provided coverage could leave him and his family vulnerable to financial hardship in unforeseen situations, such as job loss, which could result in the loss of employer-sponsored health insurance benefits. Refer our blog to know more about health insurance.

2. Aggressive Savings

To significantly boost his retirement savings, we implemented several strategies:

- Reduced Discretionary Spending: By carefully analyzing spending habits, Mr.Ravi identified areas where he could cut back on non-essential expenses. This involved reducing discretionary spending on dining out, entertainment, and other non-essential purchases.

- Clean Up Low-Yielding Investments: Mr. Ravi held several traditional insurance policies that provided inadequate insurance coverage while delivering subpar returns. These policies consumed a significant portion of his surplus income. The financial planner advised Mr. Ravi to convert these policies to paid-up status, effectively stopping future premium payments. This freed up a substantial portion of his income, which was then redirected towards more efficient and potentially higher-yielding investment products.

- Negotiated Higher Salary: Financial Planner encouraged Mr. Ravi to enhance his skills through upskilling programs. This increased his value within his current role and enhanced his job market prospects, ultimately enabling him to negotiate a higher salary.

- Introduced a Side Hustle: To supplement his income, Mr. Ravi successfully launched a consulting business, generating additional income streams dedicated towards his retirement goals.

3. Debt Management:

- Minimizing High-Interest Debt: Mr. Ravi prioritized paying off high-interest credit card debt and personal loans. This reduced Mr. Ravi’s overall financial burden and freed up a significant portion of his income for retirement savings.

- Strategic Home Loan Repayment: He implemented a “step-up EMI” strategy for his home loan repayment. This involved gradually increasing his monthly EMI payments over time, allowing him to accelerate loan repayment and potentially become debt-free by the time he retires

4. Optimize Investment Strategy:

- Increased Equity Exposure: Given Mr. Ravi’s shorter investment horizon and the need to accumulate a substantial retirement savings, he strategically increased his allocation to equities through equity mutual funds based on the historical evidence of equities generating higher long-term returns.

- Enhanced Portfolio Diversification: To mitigate investment risks, he diversified portfolio across various asset classes, including equities, debt instruments, and gold with the help of the financial planner.

- Regular Portfolio Rebalancing: Mr Ravi along with his Financial planner established a regular review and rebalancing process for the portfolio. This ensures that the portfolio’s asset allocation remains aligned with his risk tolerance, investment objectives, and changing market conditions.

5. Maximising tax benefits with retirement accounts:

- EPF & VPF: Mr. Ravi maximized his contributions in the Employee Provident Fund (EPF) and Voluntary Provident Fund (VPF) to reduce the tax liability and to build his retirement savings. Refer our blog to know more about EPF & VPF.

- NPS: Mr. Ravi Enrolled for NPS Employer NPS contributions and started contributing the maximum allowed. He also initiated self-contributions to the NPS to claim tax deductions under Section 80CCD(1B) of the Income Tax Act. Refer our blog to know more about NPS.

- PPF: Mr. Ravi also started investing in the Public Provident Fund (PPF), a government-backed savings scheme that offers tax benefits and a stable rate of return to build his retirement savings. Refer our Blog To know more about PPF

Through a combination of disciplined investment strategies, maximized contributions, and expert financial guidance, Mr. Ravi successfully bridged the gap created by his delayed start and secured a promising financial future.

While starting early offers undeniable advantages, it’s crucial to remember that even a late start doesn’t preclude the possibility of achieving a comfortable retirement. By adopting a proactive approach, embracing aggressive savings strategies, and seeking expert financial guidance, individuals can overcome the challenges of a late start and build a substantial retirement savings.

Don’t let a delayed start deter you from pursuing your retirement dreams. Contact our financial experts today for a personalized retirement plan tailored to your unique needs and circumstances. Remember, the key to successful retirement planning is to start early, but even if you haven’t, it’s never too late to begin your journey towards financial freedom.