What successful investing methods have investors like Warren Buffet followed to achieve the spectacular returns generated over their lifetime? How do they react to the various pitfalls during the course of their investment journey? How do they tackle market excesses and what sets them apart? We look here at the three Pillars of investing – Planning, Processes and Products and understand how the successful investors crack the code to win the game of investing.

Successful investing – Planning, Processes and Products

Planning – Building a strong foundation

Just like in any scenario, planning is a critical task. Successful investing starts with breaking down goals with an actionable time frame. Imagine driving without knowing your destination, you will reach nowhere for sure. It is important to have realistic goals; you can’t reach the moon even if you have the most powerful Ferrari. Size up your goals and build resources that will help you reach your destination. The right plan is the foundation to build your skyscraper.

Processes – Plans need to be implemented

The best of the plans are useless if they don’t get implemented. Implementation gets easier with the help of solid processes. Successful investors understand this and have clear cut strategy to help them achieve goals. Successful investing involves seeking professional guidance that help them avoid emotional interference and take decisions fast. They have a rule book to swear by and seldom deviate from ground rules. They understand asset allocation, valuation and re-balancing, and have fine-tuned processes to help them construct portfolios that suit different situations.

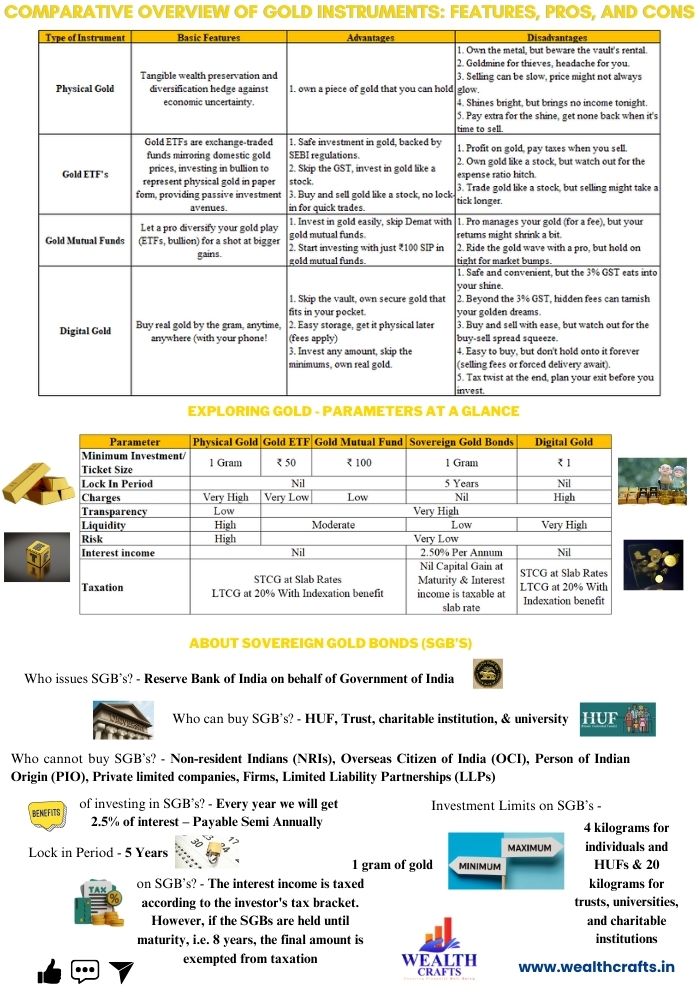

Products – Planting the right seeds

Mangos don’t grow in banana plantations. Successful investing involves doing proper homework well by collecting all relevant information. Successful investors have their facts right and use sound reasoning to take investment decisions. They do not hesitate to reach out to various experts to understand the nuances if they are not clear on anything. They nurture with great care; continuously monitoring and de-weeding their portfolio by throwing out the bad ones and give ample time to ensure their investments flourish to yield the desired fruits.

Smart investors carry a variety of ammunition in their armory and use them depending on the upcoming warfare. They delegate tasks and focus on small improvements and understand the impact of compounding on the growth of their portfolio. They keep away from market clutter and seldom get worried by what others are doing. Just like Warren Buffet, they restrict themselves to their circle of competence which protects them from taking foolish decisions and thereby save tons of money. So go ahead and implement these in your journey and grow wealth.

A SEBI Registered Investment Adviser can help you identify your goals and help you achieve them by choosing the right strategies and investment instruments. Book a Free Consultation call with our Fee Only Financial Planner today to get started today.