Why Do Stocks Markets Fluctuate?

The reason why stock markets fluctuate revolves around the theory of demand and supply. If more people want to buy a stock, its market price will increase. If more people are trying to sell a stock, its price will fall. The relationship between supply and demand is highly sensitive to the profitability of the company, general economic conditions and news.

Understanding the price fluctuation in terms of demand and supply is easy but gets trickier to know what makes investors to be bullish on a particular stock and bearish on some other stock? Theoretically, earnings are what affect investors’ valuation of a company, but there are other indicators that investors use to predict stock price. Remember, it is investors’ sentiments, attitudes and expectations that ultimately affect stock prices.

How Stock Markets Have Behaved In The Past?

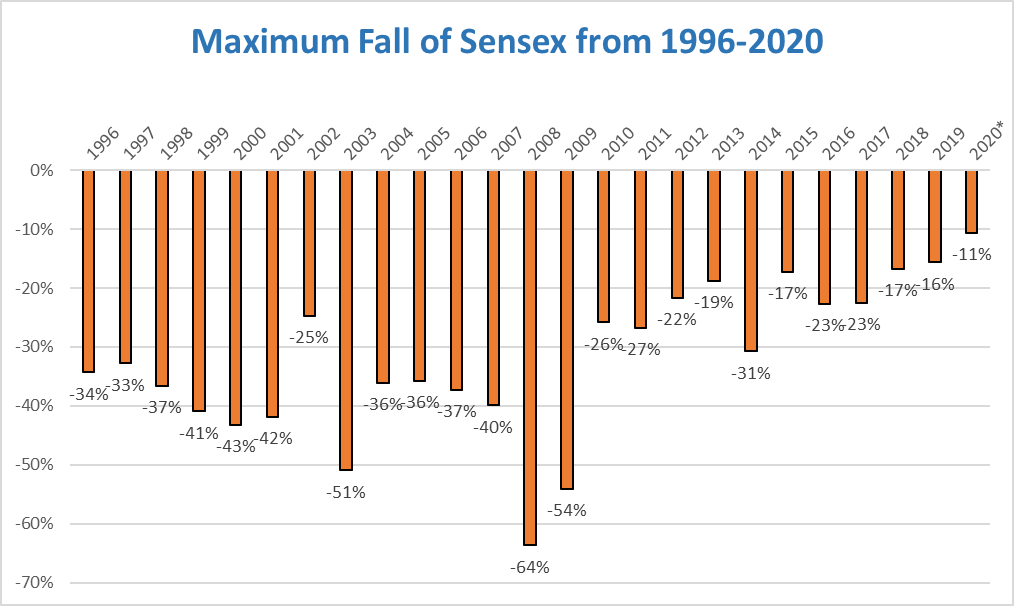

In the short term, the stock markets have tended to be very volatile with peaks and troughs, the volatility arises due to the speculation in the market, to depict the nature of the market couple of graphs have been plotted.

The above graph shows the maximum draw-downs from market peaks each year from 1996 to 2020. It is clear that the markets are volatile and it is common to see a percentage change of more than 15% in a calendar year. In the above scenario we see a percentage of change of more than -25% for 16 years out of the 25 years.

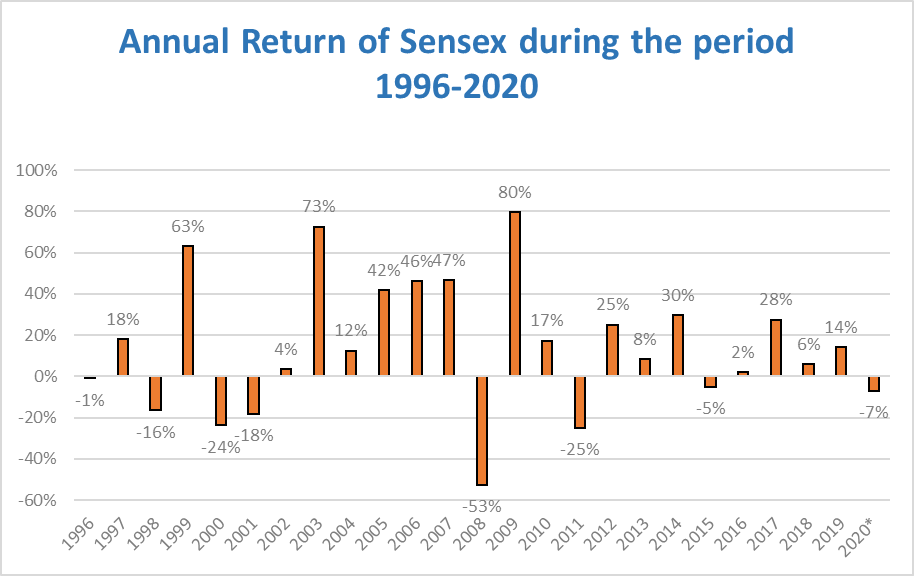

While a volatility of such magnitude is scary, the below graphs depicts the yearly returns Sensex has generated for each of the 25 years. Although there are draw-downs for each year from 1996 to 2020, the returns have not ended in negative values. The below graph makes it evident that the returns are not linear, there are years with extraordinary gains followed by negative or flat returns. One thing is clear, there is no way to predict what returns the market will be able to generate.

In the above graph we have plotted time (in years) on the horizontal axis and the percentage change every year on the vertical axis. We get to see a lot of fluctuations on both positive and negative sides which again showcase the volatile nature of the stock market.

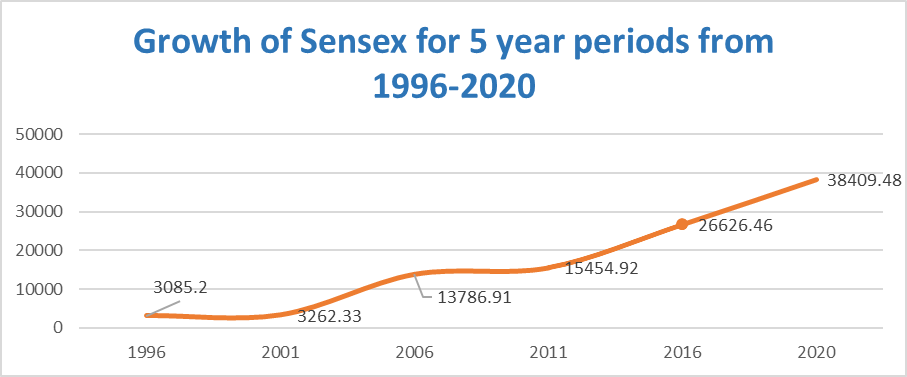

With the Sensex being volatile in the short run, a longer term horizon shows a better picture. The below graph showing the return trajectory for 5 year periods from 1996 to 2020 makes it clear for us that equity investments are not suitable for shorter periods. One may end up with flat returns even over 5 year periods, but the returns for 10 year plus horizons give us higher probability to grow wealth. The annualized returns for the 25 year period being close to 11% p.a

“In the short run, the market is a voting machine but in the long run, it is a weighing machine”, Benjamin Graham. As Graham quoted despite the dramatic swings in price, the markets have given a good return over a long period. Indicating investments in equity over a long period is the right choice.

One should not worry about short term market movements. It is best to arrive at an investment strategy that illustrates the right asset allocation matrix that is suitable to achieve one’s goals after considering your individual circumstances and preferences.

Note: *Sensex Value as on March 4th 2020. Max fall in annual Sensex value has been arrived at using the peak and bottom for each year. For annual returns the open and close values have been considered.

Get a free consultation call with a SEBI Registered Fee Only Financial Planner to help you understand the nature of stock markets and create a financial plan to achieve your goals.