Retirement planning in India, like in many other countries, often revolves around the financial aspects: savings, investments, and pension plans. However, a truly fulfilling retirement goes beyond monetary security.

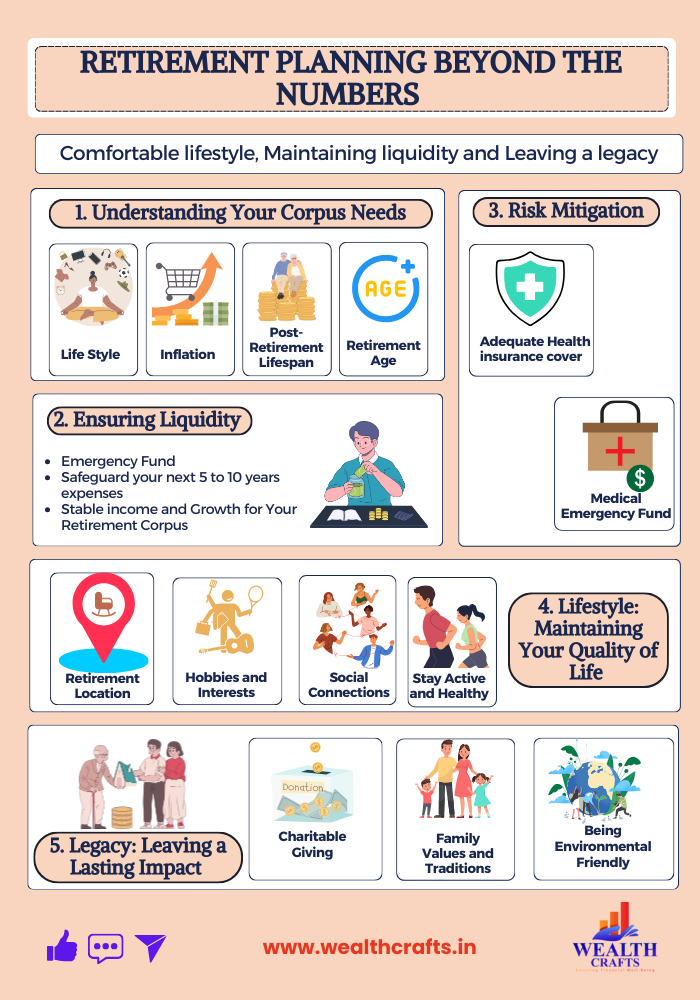

Retirement is the time to reap the rewards of years of hard work. But it’s also a time to consider how you want to spend your days, where you want to live, and what you want to leave behind for future generations. It is about ensuring a comfortable lifestyle, maintaining liquidity, and leaving a legacy.

Retirement is often seen as a time to slow down and relax. However, for many, it presents an opportunity to explore new passions, travel the world, and start a second chapter.

“We recently met a client who is hesitant to retire from his job because he’s unsure about what he’ll do with his time. He’s concerned about feeling lost or purposeless without the structure and routine of his current work.”

Here are few steps you can follow to have fulfilling retirement life:

1. Planning for a Comfortable Retirement: Understanding Your Corpus Needs

Before embarking on retirement, it’s essential to ensure you have adequate financial resources to maintain your desired lifestyle. A common guideline suggests having a retirement corpus of at least 30 times your annual pre-retirement income. This estimate assumes a withdrawal rate of 3-4% per year.

For instance, let us consider a thumb rule to understand how much you to retire by replacing your existing income if you earn ₹20 lakhs annually, a retirement corpus of ₹6 crores could be sufficient.

However, individual retirement needs vary significantly based on several factors:

- Lifestyle: Your desired standard of living will influence the amount required.

- Inflation: Rising inflation can erode the purchasing power of your savings over time.

- Post-Retirement Lifespan: The longer you expect to live in retirement, the more funds you’ll need.

- Retirement Age: The earlier you retire, the longer your savings will need to last.

If you’ve already accumulated your target retirement savings, it’s time to embark on a new chapter in life. Incase if you fall short of your target corpus, don’t despair. Consider part-time work aligned with your passions or interests to supplement your retirement income. By carefully assessing these factors and taking proactive steps, you can increase your chances of enjoying a financially secure and fulfilling retirement.

2. Ensuring Liquidity

Emergency Fund:

A crucial component of retirement planning, an emergency fund provides a safety net for unexpected expenses, such as medical bills, home repairs, or appliance break down. Consider setting aside a portion of your retirement savings in liquid assets like savings accounts, short term debt mutual funds or fixed deposits.

Safeguard your next 5 to 10 years expenses:

To shield your retirement savings from market volatility, consider allocating at least five to ten years’ worth of living expenses to fixed-income investments.

Stable income and Growth for Your Retirement Corpus:

To ensure your retirement savings maintain their purchasing power over the long term, it’s essential to focus on both stability and growth. Spread your investments across different asset classes (equity, fixed income, gold etc.) to reduce risk.

Regularly review your portfolio and adjust your asset allocation to maintain your desired risk-return balance. Avoid making impulsive decisions based on short-term market fluctuations. Focus on your long-term goals. Consider consulting with a financial advisor to develop a personalized retirement plan that aligns with your risk tolerance and financial objectives.

3. Risk Mitigation:

As you age, the likelihood of encountering health issues increases, and the costs associated with medical care can be substantial.

Adequate Health insurance cover:

Health insurance is a vital financial tool that provides coverage for medical expenses. It can protect you and your family from unexpected healthcare costs. Knowing you have adequate health insurance can reduce stress and anxiety about potential healthcare costs. Many health insurance plans cover preventive care services, such as annual check-ups and screenings, which can help maintain your health and prevent costly illnesses. It’s important to review your health insurance coverage regularly to ensure it continues to meet your needs.

Medical Emergency Fund:

While health insurance is a crucial component of retirement planning, it’s equally important to have a medical emergency fund to cover any out of hospital expenses. Even with insurance, you might still have to pay some costs incase if there is any co-pay clause or limitations on room rent or certain medical treatments.

Medical emergencies can be expensive, and your insurance might not cover everything. A Medical Emergency Fund can help you avoid selling assets or borrowing money to pay medical bills.

4. Lifestyle: Maintaining Your Quality of Life

Retirement Location:

Consider factors like climate, healthcare facilities, proximity to family, and cost of living when choosing a retirement location. Many retirees opt for smaller towns or villages to stay close to the nature and enjoy a peaceful & affordable lifestyle.

Hobbies and Interests:

Retirement offers a great opportunity to pursue hobbies and interests. Whether it’s traveling, gardening, learning a new skill, or volunteering, engaging in activities you enjoy can enhance your overall well-being.

Social Connections:

Maintaining social connections is vital for a fulfilling retirement. Stay in touch with friends and family, join clubs or organizations, and participate in community activities.

Stay Active and Healthy:

Engage in regular physical activity to maintain your health and well-being. Fuel your body with nutritious foods. Practice stress-reduction techniques like meditation, yoga, or deep breathing exercises.

5. Legacy: Leaving a Lasting Impact

Legacy is a powerful concept that extends far beyond material possessions. It’s about creating a lasting impact on the world and leaving a positive imprint on future generations. While wealth can certainly be a part of a legacy, it’s not the defining factor.

Charitable Giving:

Giving back to the community can be a meaningful way to leave a legacy. Share your knowledge and experience with younger generations. Donate to causes you care about and make a difference in your community.

Family Values and Traditions:

Pass down family values and traditions to future generations. This can involve sharing stories, preserving cultural heritage, or creating family heirlooms. Nurture your existing relationships with family and friends.

Being Environmental Friendly:

Contribute to a sustainable healthier planet for future generations by adopting eco-friendly practices and supporting environmental initiatives. Remember, every small step counts!

Are you ready to embark on a fulfilling retirement journey? Don’t let financial security be your sole focus. A truly fulfilling retirement goes beyond wealth. By considering liquidity, lifestyle, and legacy, you can create a retirement that is both comfortable and meaningful. Let’s work together to build a retirement plan that aligns with your unique goals and aspirations. Contact us today for a personalized retirement planning.