What is Inflation and How Does It Affect You?

Inflation, the gradual rise in prices of goods and services, silently erodes the purchasing power of your money. This means you’ll need to spend more to buy the same things in the future. From everyday expenses to long-term savings and investments, inflation impacts every face of your financial life.

When inflation increases, the value of money decreases. In practical terms, this means that your money buys less than it did before.

For example, if inflation is 6% annually, what costs ₹ 100 today will cost ₹ 106 next year. A typical basket of goods that costs ₹ 10,000 today will cost ₹ 10,600 in a year. Over the long term, these small increases can lead to a significant reduction in your purchasing power.

How Inflation Impacts Your Financial Planning

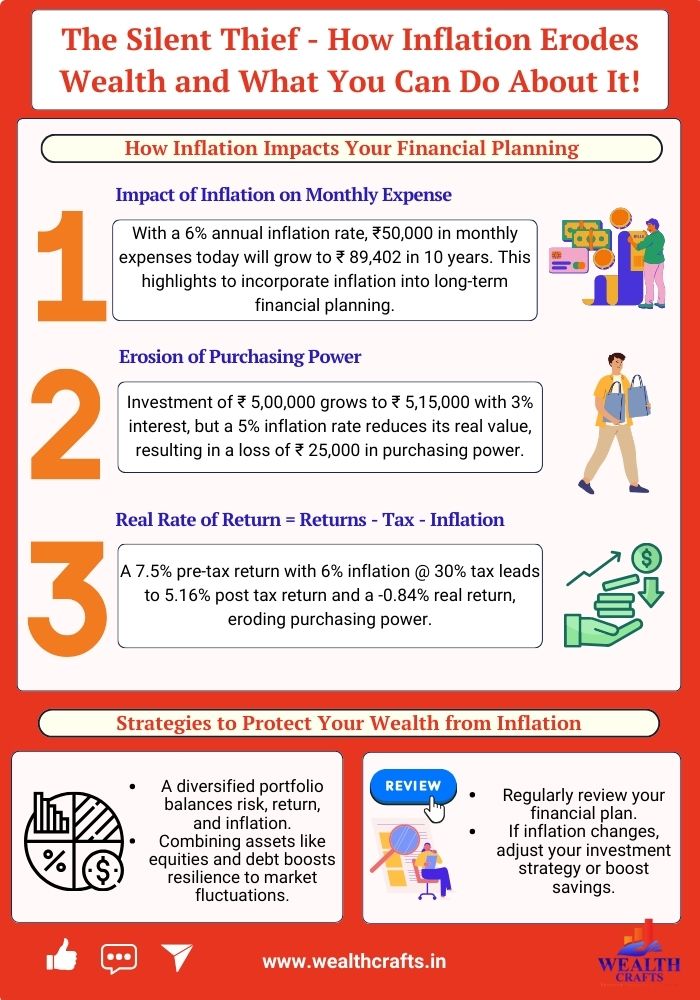

Impact of Inflation on Monthly Expense

The impact of inflation on monthly expenses over a 10-year period is significant. With a 6% annual inflation rate, ₹ 50,000 in monthly expenses today will rise to ₹ 89,402 after 10 years. This effect underscores the importance of factoring inflation into long-term financial planning.

Here’s the table showing how monthly expenses of ₹ 50,000 will rise over a 10-year period due to a 6% annual inflation rate.

Erosion of Purchasing Power

Inflation diminishes the value of your savings. If you keep large sums of money in a savings account that offers a low interest rate, like 2% – 3% annually, inflation (which may be 4% – 5% in India) will outpace your savings growth.

For example: Imagine you have ₹ 5,00,000 in your savings account, earning a modest 3% interest annually. After a year, your account balance will grow to ₹ 5,15,000. However, if inflation is running at 5% during this time, the real value of your savings has actually decreased.

You’ve effectively lost ₹ 25,000 in purchasing power. This means your ₹ 5,15,000 can only buy what ₹ 4,90,000 could buy the previous year.

Real Rate of Return – (Returns – Tax – Inflation)

Inflation has a significant impact on investment returns. If your investment returns don’t keep up with inflation, you’re effectively losing money.

For Example, Fixed deposits might offer a sense of security, but their interest rates often lag behind inflation. Let’s say you invest ₹ 5 lakhs in a fixed deposit with a 7.5% interest rate (pre-tax). While this sounds appealing, when you factor in taxes, the returns are lower.

Here’s how it works:

Pre-tax Interest Rate: 7.5%

Tax Bracket: 30% (with an additional 4% education cess, making the effective tax rate 31.2%)

Your effective post-tax return is calculated as follows:

Post-tax Return = 7.5% – (31.2% of 7.5%) = 7.5%-2.34% = 5.16%

So, after taxes, your return drops to 5.16%.

If inflation is at 6%, your returns fail to keep up with the rising cost of living. In fact, the real value of your money is being eroded over time. In the above example, the real return is effectively negative, reducing by 5.16% – 6% = -0.84%. This means that despite earning 5.16% on your fixed deposit, the purchasing power of your investment is actually decreasing, as inflation outpaces your post-tax returns.

Therefore, your money technically grows, but its purchasing power diminishes over time.

The Impact of Inflation on Education Planning

Many individuals rely on safe investments like LIC policies, Fixed Deposits (FDs), and other low-risk assets to save for their children’s education. However, inflation in education costs can outpace the growth of these savings, leaving families short of funds when the time comes.

Initial Planning:

For example, a person might invest ₹ 50,000 annually, in a safer instrument expecting an average return of 6% per year. They may plan to accumulate ₹ 12 lakhs by the time their child reaches college, assuming this amount will be enough to cover the education fee’s.

Reality Check:

After 15 years, when the child is ready for college, the tuition fees have likely risen much higher than expected, due to the 10% annual inflation in education costs. Here’s an estimate of how the costs might look:

| Expense Type | Present Value (2024) | Future Value (2039) | Education Inflation |

| Graduation Year – 1 | ₹ 3,00,000 | ₹ 12,53,174 | 10% |

| Graduation Year – 2 | ₹ 3,00,000 | ₹ 13,78,492 | |

| Graduation Year – 3 | ₹ 3,00,000 | ₹ 15,16,341 | |

| Graduation Year – 4 | ₹ 3,00,000 | ₹ 16,67,975 | |

| Total 4 Year’s Cost | ₹ 12,00,000 | ₹ 58,15,983 |

In 2024, he might have thought that ₹ 12 lakhs would be sufficient to cover his child’s four-year education. However, due to inflation, the reality in 2039 is quite different. The annual education fee per one year is to be around ₹ 12.53 lakhs, far exceeding his initial savings goal. This difference highlights the significant impact of inflation on long-term financial planning.

Note: We have considered a 10% annual education inflation rate for calculations, the actual rate varies and can be higher or lower.

Why Safe Investments May Fall Short:

- Low Returns on Safe Assets: fixed income instruments typically offer returns of around 5-6% per year. This return rate is lower than the 10% inflation rate in education costs, meaning the savings are not growing fast enough to meet the future expenses.

- Underestimating Inflation: Many people underestimate how much inflation can affect costs over the long term, especially in critical areas like education. This can lead to a significant gap between expected savings and actual expenses.

To stay ahead of rising education costs, individuals should factor in inflation when planning for long-term financial goals. Relying solely on low-risk assets may not be enough. Exploring higher-return investment options like mutual funds or equities can help grow the savings more effectively over time, even though these investments come with higher risk. Regularly reviewing and adjusting savings goals based on inflation rates & with proper strategies will help ensure that the required funds are available when needed.

What You Can Do About It: Strategies to Protect Your Wealth from Inflation

To counter the impact of inflation, you should consider investing in assets that tend to outpace inflation over time

Stocks and equity mutual funds often beat inflation over the long term, offering returns that can outpace inflation. For instance, the Nifty 50 Index has historically provided annual returns of around 12% – 14%, which comfortably beats inflation.

Disclaimer: The performance of the Nifty 50 Index is shown here for educational purposes only and is not an investment recommendation. Past performance is not indicative of future results. Always conduct thorough research or consult with a financial advisor before making any investment decisions.

- Create a Diversified Portfolio: A well-diversified investment portfolio is crucial for balancing risk and return while protecting against inflation. By including a mix of assets such as equities and debt, you can spread your risk and ensure that your portfolio remains resilient to inflation. Diversification helps position your portfolio to better handle economic fluctuations, inflation, and other market challenges.

- Review Your Financial Plan Regularly: Inflation rates can fluctuate, so it’s essential to review and adjust your financial plan regularly. evaluate your portfolio, expenses, and savings goals. If inflation increases, consider revising your investment strategy or increasing your savings rate to stay on track and protect your purchasing power.

Inflation is a part of managing your finances, but it doesn’t have to derail your goals. By understanding how inflation affects your finances and taking steps to protect your wealth, you can ensure your savings grow faster than inflation. Make sure you

- Diversify your investments,

- Review your financial goals regularly, and

- Consider assets like equities that can protect against inflation.

With these strategies, you can preserve your purchasing power and stay on track to reach your long-term financial goals. Remember, it’s not just about coping with inflation it’s about making smarter, more informed financial decisions!

Understanding the impact of inflation on your financial planning is crucial. Let’s discuss how you can adjust your strategies to account for inflation, diversify investments, and safeguard your financial future. Schedule a free consultation call today to ensure your financial plan is designed to withstand inflation.