Home loan prepayment or investment of bonus for goals can be tricky. This decision involves not only financial considerations but also emotional factors that can significantly impact your overall well-being. Let’s explore two different scenarios to help you make an informed choice.

Scenario 1: Fixed EMI Without Home Loan Prepayment

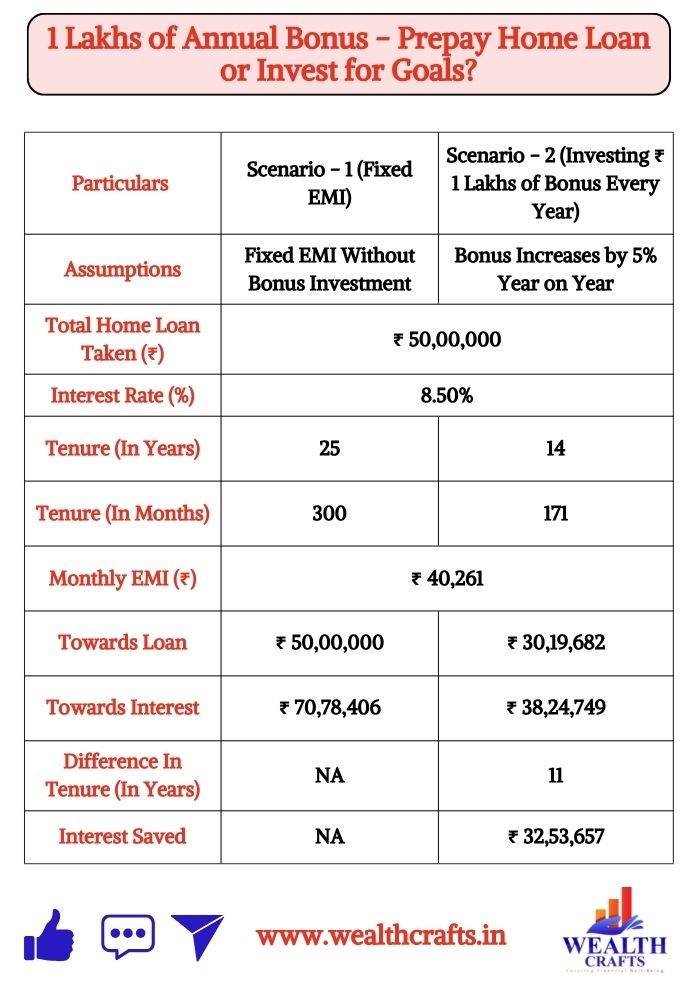

In this scenario, you opt to continue paying your fixed EMI of ₹ 40,261 over a 25-year period without Home Loan Prepayment. While this path offers stability and predictability, it also means committing to a long-term financial obligation. Over the loan period, you would end up paying a staggering total of ₹ 70,78,406 in interest alone.

From a financial perspective, this choice may weigh heavily on your budget for years to come. The large monthly EMI can limit your surplus income, making it challenging to save for emergencies or invest in other opportunities. Additionally, the total cost of the loan including both principal and interest can significantly erode your financial resources, impacting your ability to reach other financial goals such as retirement, children’s education, or even travel.

Emotionally, the burden of a large, ongoing loan can lead to stress and anxiety, particularly if unexpected expenses arise. The thought of being tied to debt for decades can overshadow the excitement of achieving other life goals. This ongoing commitment may also lead to feelings of financial insecurity, as you might constantly worry about meeting your monthly obligations, especially during times of economic uncertainty.

Scenario 2: Use Bonus for Home Loan Prepayment

In the second scenario, you decide to use ₹ 1 lakh of your bonus each year towards Home Loan Prepayment, and you are getting 5% of hike in bonus annually. This strategy not only allows you to reduce the principal amount of your loan but also shortens the loan tenure to just 14 years. As a result, you would pay approximately ₹ 38,24,749 in interest an impressive interest savings of ₹ 32,53,657.

Financially, Home Loan Prepayment enables you to allocate your resources more effectively, potentially building wealth over time while simultaneously paying off your loan faster. The shorter loan tenure provides a sense of accomplishment and financial freedom, allowing you to redirect your efforts toward other investments or personal goals.

On an emotional level, the relief of seeing your loan being paid off sooner can be incredibly satisfying. You may find that the peace of mind that comes from reducing debt significantly outweighs the immediate gratification of using the bonus for other purchases. This choice fosters a sense of control over your financial destiny, empowering you to make long-term plans without the weight of a prolonged loan tenures.

Deciding on Home Loan Prepayment or investment for goals requires careful consideration of both financial and emotional factors. If you prioritize immediate savings and reduced debt, prepaying the loan may provide you with the peace of mind you seek. However, if your focus is on long-term wealth creation and financial growth, using your bonus to invest could be the more advantageous path.

Ultimately, it’s important to consider your unique financial situation, personal goals, and emotional comfort with debt. If you have immediate financial goals such as a vacation, a major purchase, or building an emergency fund using your bonus to fulfil those needs can be a practical decision without Home Loan Prepayment. Prioritize these goals, especially if they align with your overall financial plan.

On the other hand, if you don’t have immediate financial needs, Home Loan Prepayment can be a strategic move. This approach can help reduce your long-term debt burden and save you money on interest costs.

If you’re unsure whether to prepay your home loan or invest your bonus, this decision can significantly impact your financial future. Schedule a free consultation call with us today to discuss your unique situation, explore your options, and develop a tailored strategy that aligns with your financial goals. Don’t leave your future to chance let’s work together to make informed decisions that will set you on the path to financial success!