In today’s dynamic financial landscape, let’s understand the 5 differences between regular mutual funds and direct mutual funds. Whether you’re a seasoned investor or just starting out, the sheer number of options and the constant market fluctuations can be daunting.

Mutual funds have become an increasingly popular investment avenue in India, offering individuals a convenient and accessible way to participate in the growth of the country’s capital markets. These professionally managed funds pool money from numerous investors, allowing diversification of investments across various asset classes like stocks, bonds, and other securities.

Mutual funds provide advantages such as professional expertise, potential for higher returns, and the ability to invest even small amounts, making them a compelling choice for investors with varying risk tolerances and financial goals. As the Indian economy continues to develop, mutual funds are poised to play an increasingly significant role in the financial landscape.

Let us delve into the 2 primary types of mutual funds in India and understand the differences between regular mutual funds and direct mutual funds;

2 Types of Mutual funds based on their distribution:

- Regular Mutual Funds: In this type of Mutual funds, the investor invests in the funds through a broker, distributor, or any other intermediary. The fund house pays a commission to the intermediary, which is factored into the fund’s expense ratio. This commission leads to a higher expense ratio for regular plans compared to direct plans, ultimately impacting your returns.

- Direct Mutual Funds: In this type of Mutual funds, the investor invests in the funds directly through the Asset Management Company (AMC) that manages the fund. There’s no broker or advisor involved. No commissions paid out, resulting in a lower expense ratio. This leads to potentially higher returns for investors over the long term.

The primary differences between regular mutual funds and direct mutual funds lie in the way you purchase them and their associated costs. Direct mutual funds offer a more cost-effective way to invest, potentially maximizing your returns over time.

Let us understand the differences between regular mutual funds and direct mutual funds with an example:

Assume that you have invested in a regular equity mutual fund portfolio of around Rs. 10 Lakhs, then the average expense ratio in regular mutual funds is around 1% higher than the direct mutual funds.

Hence the AMC pays around 1% (which is factored in your expense ratio) on Rs. 10 lakhs of your investments i.e., Rs. 10,000 every year as commission to the mutual fund distributor or intermediary until you stay invested in the regular mutual fund. With the growth in your corpus the commission of Mutual fund distributor will also increase resulting the lower net returns in comparison with direct mutual funds in long run.

Let us investigate the 5 Major differences between regular mutual funds and direct mutual funds;

- Higher Expense Ratio: Regular mutual funds typically have a higher expense ratio compared to direct mutual funds. This is because regular mutual funds pay commissions to distributors for selling their funds, which adds to the overall cost for investors. This seemingly small difference between regular mutual funds and direct mutual funds can significantly impact your returns over the long term.

- Lower Returns: The notable difference between regular mutual funds and direct mutual funds are their net returns. Due to the higher expense ratio, the returns you earn in a regular plan will be slightly lower than the direct plan of the same fund or scheme. This can be a crucial factor for long-term wealth creation.

- Commission Payments: Another major difference between regular mutual funds and direct mutual funds is the commission payments. Since regular mutual funds involve intermediary distributors, commissions or fees are paid to them. These commissions are usually embedded in the expense ratio and can reduce the returns for investors over the long term.

- Conflict of Interest: The intermediaries may recommend mutual funds that offer them higher commissions rather than those that are most suitable for investors’ needs. This conflict of interest may not always align with the investor’s best interests.

- Lack of Control and transparency: With regular mutual funds, investors have limited control over their investments. Any changes or updates to the fund may not be directly communicated to the investor, leading to a lack of transparency. The commissions structure in regular plans can be opaque, making it difficult to understand how much of your investment goes towards fund management.

Understanding the tax implications and exit loads when exiting regular mutual funds and reinvesting in direct mutual funds:

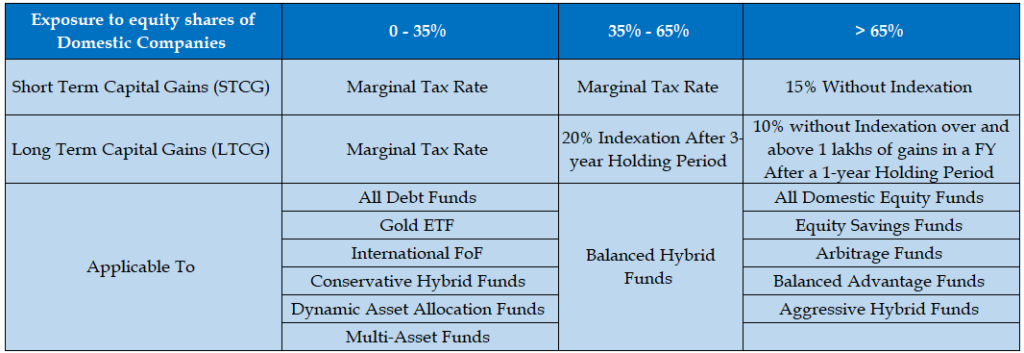

- Capital Gains Tax: Any capital gains arising from the redemption of regular mutual funds are subject to capital gains tax in India. The tax rate depends on the holding period of the investment (short-term or long-term) and the type of mutual fund (equity or debt or hybrid).

In case of equity Mutual funds, the holding period is one year. If you sell your regular fund units within the holding period, you will be taxed at short-term capital gains rate, which is typically higher than the long-term capital gains tax rate. Consider holding onto your existing units until they reach the long-term holding period to benefit from lower tax rates.

- Indexation Benefit: In the case of debt mutual funds invested before 31/3/2023, investors have the option to avail of indexation benefit while calculating capital gains tax if the investment period exceeds three years. This can help in reducing the tax liability by adjusting the gains for inflation. Refer to the blog to understand more about debt mutual funds and their taxation. Do note that indexation benefit was withdrawn on investments made after 1st April 2023 except for those hybrid mutual funds where the equity allocation was > 35% but < 65%.

- Exit Load: Some mutual funds may have exit loads, which are fees charged when investors redeem their investments within a certain period. These exit loads can reduce the net amount received upon redemption.

- Tax on Reinvestment: When reinvesting the proceeds from regular mutual funds into direct mutual funds, the reinvestment itself does not trigger any tax implications. However, any future capital gains generated from the direct mutual funds will be subject to capital gains tax when redeemed.

Before making any decisions regarding switching from regular mutual funds to direct mutual funds, it’s advisable to consult with a financial advisor or tax consultant to understand the specific tax implications based on your individual circumstances. Additionally, investors should consider factors such as their investment goals, risk tolerance, and investment horizon before making any changes to their investment portfolio.

Remember, Understanding the difference between regular mutual funds and direct mutual funds and choosing between them is crucial for your long-term investment success. Carefully consider the cost difference between regular mutual funds and tax implications before making a decision. Don’t wait any longer! Take control of your financial future. Our financial experts are here to help!

Book your free consultation call today and discover how we can help you understand the differences between regular mutual funds and direct mutual funds and guide you through the process of exiting regular mutual funds and crafting a personalized financial plan for your future success. Make informed investment decisions and unlock the potential of mutual funds for your financial success. So, buckle up, get comfortable, and let’s embark on this journey together!