Base Policy and Super Top Up Policy are two commonly used options while taking Health Insurance. Health insurance is an important tool to safeguard your financial well-being against unexpected medical expenses. As medical treatments become more expensive, people are often looking for ways to enhance their coverage. While both serve to provide coverage for hospitalization and medical expenses, they work differently and are designed for different needs.

Let’s dive into these two types of policies to understand what they offer, how they differ, and when to choose one over the other.20

What is a Base Health Insurance Policy?

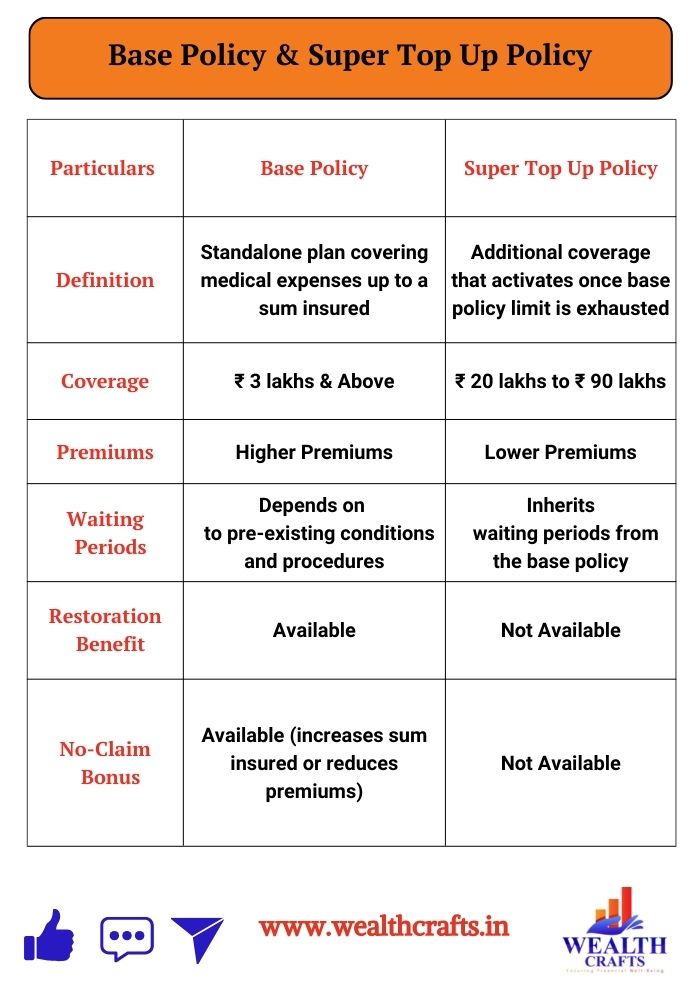

A Base Health Insurance Policy is the primary health insurance policy you purchase to cover your medical expenses. It provides a fixed sum insured for hospitalization and associated medical expenses, typically ranging from ₹ 3 lakhs and above. The base policy covers a variety of medical expenses such as hospital stays, surgeries, doctor consultations, and diagnostic tests.

When you buy a base policy, you choose a sum insured (the maximum amount the insurer will pay in case of hospitalization). This sum insured typically applies across a wide range of medical expenses, but if your medical bills exceed the coverage limit, you would have to bear the extra costs.

For example, if your base policy has a sum insured of ₹ 5 lakhs, the insurance company will cover your medical bills up to ₹ 5 lakhs for a given year. If your bills exceed this amount, you would need to pay the difference.

What is a Super Top-Up Policy?

A Super Top-Up Policy is an extension to your existing health insurance coverage, designed to cover expenses that exceed the limits of your base health insurance policy.

The super top-up policy kicks in when your medical expenses exceed the sum insured of your base policy. This means it provides additional coverage for high-value medical emergencies.

Example

Imagine you have a base health insurance policy with a sum insured of ₹ 5 lakhs. You decide to enhance your coverage by purchasing a super top up policy with a sum insured of ₹ 25 lakhs

Base Policy and Super Top Up Policy: How Do They Work Together?

A Base Policy is your essential coverage, and you can think of it as your primary health insurance plan. It’s straightforward, with a clear sum insured, and typically takes care of most medical situations. However, if you’re concerned about major medical expenses that might exceed the sum insured, a Super Top Up Policy is a great addition.

Let’s explore a more detailed breakdown of how these two policies complement each other:

Base Policy: First Layer of Protection

- The base policy provides the first layer of financial protection.

- If you’re hospitalized and the medical costs are within the sum insured of the base policy, it takes care of the entire bill.

- If the medical bills exceed the base policy limit, you would need to pay out-of-pocket unless you have a super top up policy.

Super Top Up Policy: Additional Coverage Beyond Base Health Insurance Limit

- The super top-up policy doesn’t increase the sum insured of the base policy directly. Instead, it acts as a safety net once the base policy’s coverage is exhausted.

- You only start using the super top-up policy once you exhaust the base cover.

- It offers more coverage at a relatively lower cost than increasing the sum insured of your base policy.

Let us understand base policy & super top up policy with an example

Scenario 1: Minor Illness

You get hospitalized for a minor illness, and the total medical expenses amount to ₹ 3 lakhs.

- Base Policy: Covers the entire ₹ 3 lakhs as it’s within the sum insured.

- Super Top-Up Policy: Not applicable, as the medical expenses are covered by the base policy.

Scenario 2: Major Illness

You’re diagnosed with a serious illness and require hospitalization. The total medical expenses reach ₹ 20 lakhs.

- Base Policy: Covers ₹ 5 lakhs, if you have taken a cover for ₹ 5 lakhs.

- Super Top-Up Policy: Since your total expenses exceed the base policy’s limit, the super top-up policy (provided, if you have taken a super top up cover) will kick in and cover the remaining ₹ 15 lakhs.

Note: If you do not have a super top-up policy, and your medical expenses exceed the coverage provided by your base policy, you will be personally responsible for paying the difference.

From the above scenario, where your total medical expenses are ₹ 20 lakhs, and your base policy only covers up to ₹ 5 lakhs, the remaining ₹ 15 lakhs will not be covered under your base policy. If you don’t combine base policy and super top up policy to cover the excess, you would need to pay this ₹ 15 lakhs difference out of your own pocket.

Benefits of Combining a Base Policy and Super Top Up Policy

- Cost-Effective Extra Coverage: The super top-up policy offers additional protection at a lower premium than increasing the sum insured of the base policy. This makes it a cost-effective way to extend your coverage, especially for high medical bills.

- Comprehensive Protection: By combining both base policy and super top up policy, you are covered for smaller medical bills under the base policy and have extra protection for larger, unexpected medical costs through the super top-up.

Who Should Consider a Super Top Up Policy?

- Individuals with Existing Base Policies: If you already have a base policy but want to enhance your coverage without significantly increasing premiums, a super top-up policy is an ideal choice.

- Those Concerned About High Medical Costs: If you’re worried about the rising cost of medical treatments and the potential for large medical bills, a super top-up policy can provide the necessary financial protection.

- Individuals Seeking Protection Against Catastrophic Events: For those who want to safeguard themselves against catastrophic medical events like major surgeries, critical illnesses, or accidents, a super top-up policy can offer peace of mind.

Even if you’re currently healthy, it’s wise to be prepared for unforeseen health emergencies. A super top-up policy can provide the necessary coverage to protect your financial well-being.

Ultimately, a super top-up policy can make sense for almost everyone. It offers a cost-effective way to enhance your health insurance coverage and protect yourself from financial strain in the event of significant medical expenses. By carefully considering your specific needs and budget, you can determine if a super top-up policy is the right choice for you.

Note: It’s better to purchase a base policy and super top up policy from the same insurance company. This can easily streamline the claims process and potentially offer additional benefits or discounts.

Are you confident that your current health insurance policy is sufficient to cover unexpected medical expenses? Understanding the nuances of your base policy and the benefits of a super top-up policy can make all the difference in your financial planning and peace of mind.

Don’t leave your health and financial security to chance! Dive deeper into how a super top-up policy can provide the additional coverage you need without breaking the bank.

Take control of your health insurance today! Schedule a free consultation call today to understand how to optimize your health insurance coverage using base policy and super top up policy for maximum protection and savings. Your future self will thank you!