The widespread availability of personal loans and credit cards has made it easier than ever to access credit. While these loans can provide temporary financial relief, their long-term impact on wealth accumulation can be substantial, particularly if they are not managed responsibly. These types of unsecured loans carry very high interest rates which may lead to debt trap and can significantly erode one’s financial resources.

Furthermore, the burden of debt can limit an individual’s ability to save and invest, hindering their potential for wealth growth. Understanding the potential consequences of personal and credit card loans is crucial for making informed financial decisions and ensuring a secure financial future.

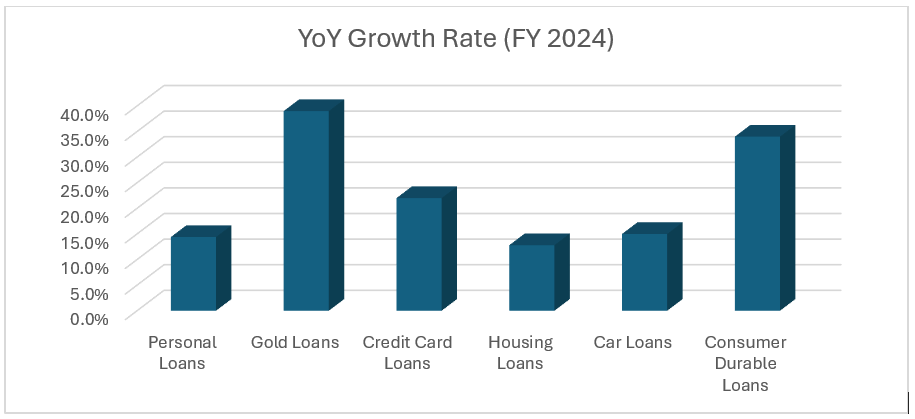

Understanding the Indian Loan Market;

Here is the break down that shows the growth rates year on year basis as of September 2024 in India.

Loan Type YoY Growth Rate (FY 2024)

| Loan Type | YoY Growth Rate (FY 2024) |

| Personal Loans | 14.4% |

| Gold Loans | 39.0% |

| Credit Card Loans | 22.0% |

| Housing Loans | 12.8% |

| Car Loans | 15.0% |

| Consumer Durable Loans | 34.0% |

Personal loans:

Personal loans continue to be the largest segment of non-food credit, indicating their popularity and widespread use. As of September 2024, personal loans grew 14.4% year-on-year, reaching nearly Rs 55.3 lakh crore. This is the largest share of non-food credit, at 32.9%.

Gold Loan:

Gold loan grew the fastest within personal loans, increasing by 39%. This suggests that people are increasingly using gold jewellery as collateral to secure loans.

Credit Card Loans:

As of September 2023, the number of credit card holders in India had increased to 7.80 crore. The credit card balance in the country has increased 3.8 times from ₹65,843 crore to ₹2,22,238 crore between July 2017 and September 2023. Maharashtra leads the country in credit card usage, accounting for over 65% of the total credit card outstanding.

The surge in credit card usage in India is primarily driven by several factors. The expanding middle class and urbanization have led to higher disposable income, fueling the demand for consumer credit. Digital payment methods have simplified the application and management of credit cards, making them more accessible.

Moreover, credit card issuers have attracted customers with enticing rewards like cashback, loyalty points, and exclusive offers. Finally, the Reserve Bank of India’s relaxed regulations for credit cards have further boosted their adoption.

Housing loans:

The growth rate of housing loans has also slowed down, indicating a potential decline in demand for home loans.

Car loans:

Car loan growth in India slowed down to 15% year-on-year (y-o-y) from 23% in the same period in 2023 majorly due to the higher interest rates.

Consumer durable loans:

Consumer durable loans in India grew by 34% year-on-year (YoY) in FY24, up from 26% growth in the previous year. This growth was driven by larger ticket sizes, though origination volumes only increased by 8.5% in FY24, compared to 38.2% in FY23.

Overall, the data indicates a mixed trend in the Indian loan market. While some segments like personal loans and gold loan continue to show strong growth, others like housing loans and bank credit have experienced a slowdown. This could be due to various factors such as economic conditions, interest rate hikes, and changes in consumer behavior.

Here’s a breakdown of the potential consequences of taking a personal loan:

1.High Interest Rates: One of the most significant drawbacks of personal loans is the high interest rates they often carry. These rates can compound quickly, making it difficult to pay off the loan and increasing the overall cost of borrowing.

2. Debt Trap: The high interest rates on personal loans can easily lead to a debt trap. If you are unable to make the monthly payments on time, the interest will continue to accumulate, making it even more difficult to pay off the loan. This can create a vicious cycle of debt that can be challenging to break out of.

3. Reduced Savings: The monthly payments for a personal loan can significantly reduce your disposable income, making it more difficult to save for long-term goals such as retirement, education, or a home. This can have a long-term impact on your wealth accumulation.

4. Damaged Credit Score: Late or missed payments on a personal loan can damage your credit score, making it more difficult to obtain future loans or credit cards. A damaged credit score can also lead to higher interest rates on future loans, further increasing your financial burden.

5. Financial Stress: The burden of debt can lead to financial stress and anxiety, which can negatively impact your overall well-being. This can make it difficult to focus on your financial goals and make sound financial decisions.

How to avoid personal loans and credit card debt:

Personal loans and credit card debt can significantly impact your financial well-being. Here are effective strategies to avoid them:

Here are effective strategies to avoid them:

1. Build an Adequate Emergency Fund:

- Aim for 6 months’ expenses: A well-funded emergency fund can cover unexpected expenses like medical bills, job loss, appliances break down or car repairs, reducing the need to borrow.

- Regularly contribute: Set aside a portion of your income each month to build your emergency fund.

- Invest wisely: Consider investing your emergency fund in a high-yield savings account or a short-term fixed deposits or debt mutual funds for better returns.

2. Invest in Comprehensive Health Insurance:

- Protect against medical emergencies: A good health insurance plan can cover a significant portion of your medical expenses, preventing the need to borrow for unexpected medical bills.

- Choose a plan that suits your needs: Consider factors like coverage limits, deductibles, and co-payments when selecting a health insurance plan.

3. Create and Stick to a Budget:

- Track income and expenses: Carefully monitor your income and expenses to identify areas where you can cut back.

- Prioritize essential expenses: Allocate funds for essential expenses like housing, food, and utilities. You can follow 50:30:20 rule – 50% for essential expenses, 30% for savings and debt repayment& 20% for discretionary expenses.

- Set financial goals: Define short-term and long-term financial goals to stay focused and motivated.

4. Control Your Spending:

- Avoid impulse purchases: Be mindful of your spending habits and avoid unnecessary purchases.

- Use cash or debit cards: Limit the use of credit cards to avoid accumulating debt.

- Practice delayed gratification: Give yourself time to think before making a purchase, especially for larger items.

How to get rid of personal loans and credit card debt:

If you find yourself in a situation where borrowing is unavoidable, consider these strategies to minimize interest costs and pay off your loan quickly:

1. Borrow Only What You Need:

- Assess your financial situation: Carefully evaluate your income, expenses, and existing debt to determine how much you can comfortably afford to borrow.

- Avoid impulse purchases: Don’t borrow money for unnecessary items or impulsive purchases. Focus on borrowing for essential needs or investments with a clear return on investment.

- Consider alternative financing options: Explore options like saving up for purchases or negotiating with sellers for better terms before resorting to loans.

2. Compare Interest Rates:

- Shop around: Don’t settle for the first loan offer you find. Compare interest rates, fees, and terms from multiple lenders to find the best deal.

- Consider different loan types: Explore various loan options, such as personal loans, credit card loans, and home loans, to determine which one best suits your needs and financial situation.

- Check for hidden fees: Be aware of any additional fees or charges associated with the loan, such as processing fees, prepayment penalties, or late payment fees.

3. Pay Off Debt Quickly:

- Cut Back on Non-Essential Expenses: Reduce or eliminate expenses like dining out, subscription services, or unnecessary purchases. Explore free or low-cost options for entertainment, hobbies, and other activities. Whenever possible, make additional payments on your loans to reduce the principal amount and interest accrued.

- Prioritize high-interest debt: Focus on paying off loans with the highest interest rates first to minimize the total cost of borrowing.

- Consider debt consolidation: If you have multiple debts, consider consolidating them into a single loan with a lower interest rate.

The Power of Frugal Living: Building Wealth for the Long Term

For example, let us consider Mr. Ram & his family considered taking a Personal loan of Rs. 10 lakhs for lifestyle upgradation at a 12% interest rate over a 5-year tenure.

| Loan Amount: | ₹ 10,00,000 |

| Number of EMIs: | 60 |

| Annual Interest Rate: | 12% |

| Monthly EMI Payment: | ₹ 22,244 |

| Total Loan Amount Payable: | ₹ 13,34,667 |

| Total Interest Payable: | ₹ 3,34,667 |

If the family had invested the monthly EMI amount (Rs. 22,244) in an equity mutual fund yielding 10% per year for 5 years and continued to invest the accumulated amount for the next 20 years, they could have potentially built a corpus of approximately Rs. 1.15 crores by the end of 25 years.

| Time frame | Monthly Contributions | Future value |

| 1 – 5 Years | ₹ 22,244 | ₹ 17,03,028 |

| 5 – 10 years | Nil | ₹ 27,42,744 |

| 10-15 years | Nil | ₹ 44,17,216 |

| 15 – 20 years | Nil | ₹ 71,13,971 |

| 20 – 25 years | Nil | ₹ 1,14,57,121 |

Adopting a frugal lifestyle, especially during the early years of your career, can significantly impact your long-term financial health. By being mindful of your spending and prioritizing savings and investments, you can leverage the power of compounding to build substantial wealth over time.

By following these, you can borrow responsibly and minimize the negative impact of loans on your financial well-being. Remember, responsible borrowing is key to achieving your long-term financial goals.

Take control of your financial future! Schedule a free consultation with our experienced financial planner today. By understanding the potential risks and benefits of personal and credit card loans, we can help you develop a personalized financial plan that aligns with your long-term goals. Don’t let debt hold you back. Book your consultation now and start building a brighter financial future.