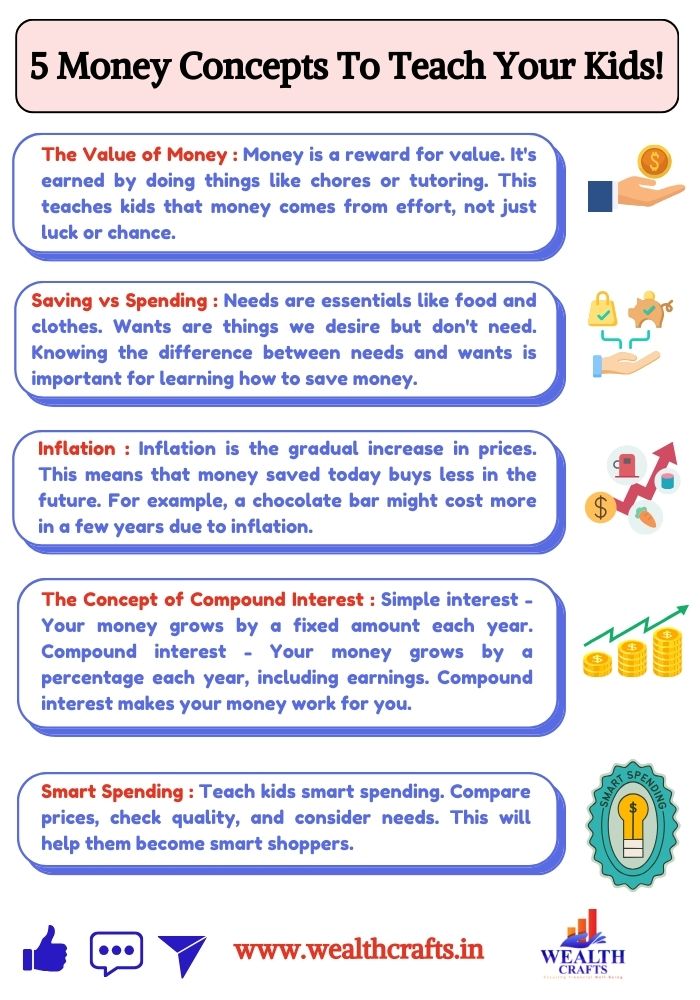

Teaching kids about money concepts is really important for their future. By helping them learn money management skills from a young age, you can prepare them to handle their finances confidently as they grow. Here’s a simple look at five key money concepts every child should understand.

The Value of Money Concepts

Start by explaining what money is and how people earn it. Money represents value and comes from things you do, like helping out around the house, completing chores, or by tutoring younger students in subjects like math or science. These activities show that you can earn money by putting in effort. This helps kids understand that money isn’t just a number; it’s something you get through hard work and time.

Practical Tip

Consider giving your kids a small amount of money for doing certain tasks around the house. This helps them learn how to earn money and also teaches them to be responsible. For younger kids, chores like cleaning their room or helping with the dishes can be good tasks to start with. As they get older, you can give them bigger jobs, like doing yard work or helping with family projects, and they can earn a bit more money for those.

Saving vs. Spending

Help your kids understand the difference between needs and wants. Needs are things we must have to live, like food and clothes, while wants are things we would like to have but don’t really need, like toys or video games. Knowing this difference is important for learning how to save money. Explain that saving helps them reach bigger goals, like buying a special toy or going on a fun trip. Encourage them to think about what they really want and how saving a little bit can help them get it over time!

Practical Tip

You can create a savings jar or help them open a digital savings account. Let your kids pick something special they want to save for, like a new toy bike, a video game, or even a cool toy they’ve been wanting. As they add money to their jar or account, celebrate their progress! You can say things like, “Wow, you’re getting closer to your toy bike!” This makes saving fun and exciting. They might also want to save for things like going to a theme park, getting a pet, or buying new art supplies. Watching their savings grow will help them see that they can reach their goals with a little patience!

Encouraging Goal Setting

You can further enhance this lesson by discussing short-term versus long-term goals. Encourage your kids to save for something small they can achieve in a few weeks, and also a larger goal that may take months. For example, they could aim for a new toy costing ₹ 500, which they can achieve in five weeks by earning ₹ 100 each week from chores.

For a larger goal, like a bicycle costing ₹ 3,000, they would need to save ₹ 100 each week for 30 weeks. This approach teaches them the value of patience and planning, and the satisfaction of reaching their goals. By working towards these targets, they learn important lessons about saving and the rewards of staying committed.

Inflation

Once your kids understand how to earn and save money, it’s time to talk about inflation, which is the gradual increase in prices of goods and services over time. This means that the money they save today may not buy as much in the future. For example, if a chocolate bar costs ₹ 50 today, it might cost ₹ 60 in a few years due to inflation.

Practical Tip

Encourage your kids to keep track of the prices of their favourite items over time. For example, they could choose items like a chocolate bar, a toy, or a book. They can create a simple chart or use a notebook to note down how much these items cost each month or year.

| Item | Jan-22 | Jan-23 | Jan-24 |

| Chocolate Bar | ₹ 50 | ₹ 55 | ₹ 60 |

| Favourite Toy | ₹ 500 | ₹ 550 | ₹ 600 |

| Book | ₹ 300 | ₹ 330 | ₹ 360 |

This activity will help them see how prices change due to inflation. For instance, they can observe that the chocolate bar increased from ₹ 50 to ₹ 60 over two years. This shows them that if they only save their money without earning interest, they may find that their savings can’t buy as much in the future.

By visualizing these changes, they’ll better understand why it’s important for their savings to grow ideally at a rate that outpaces inflation! This can motivate them to look for ways to earn more interest on their savings or explore smart investment options.

The Concept of Compound Interest

Teach your kids about compound interest.

Understanding Compound Interest with a Simple Example

Imagine you have a piggy bank with ₹100. Every year, your parents give you ₹10 more. This is like simple interest.

Now, imagine your piggy bank grows by 10% every year, on top of what you add. This is compound interest.

With compound interest, your money not only grows from the original amount you invested but also from the earnings it has already made. It’s like your money is working for you!

Here’s how it works:

| Year | Simple Interest (₹) | Compound Interest (₹) |

| 1 | 100 + 10 = 110 | 100 + 10% of 100 = 110 |

| 2 | 110 + 10 = 120 | 110 + 10% of 110 = 121 |

| 3 | 120 + 10 = 130 | 121 + 10% of 121 = 133 |

| 4 | 130 + 10 = 140 | 133 + 10% of 133 = 146 |

| 5 | 140 + 10 = 150 | 146 + 10% of 146 = 161 |

| 10 | 200 | 259 |

| 15 | 250 | 400 |

As you can see, compound interest makes your money grow much faster. The longer you let it grow, the more it will be worth!

Practical Tip

Encourage them to start saving early, even if it’s just a small amount. For example, they could set aside a portion of their earnings each month. The sooner they start investing, the more they can benefit from compound interest over time. You can help them set up a simple savings goal and track their progress to see how their money grows!

Smart Spending

Teach your kids how to make smart choices when spending money. Talk about why it’s important to compare prices, check the quality of items, and think about whether they really need something before buying it. For example, if they want a new toy, encourage them to look at different shops or online websites to see where they can get the best price. You can also ask them to consider if they’ll really play with it often or if they just want it because it looks cool. This will help them become smart shoppers!

Practical Tip

Before going on a shopping trip, encourage your kids to create a shopping list. Teach them to stick to the list and resist impulse buys. Discuss the importance of waiting before making a purchase, which can help them determine if it’s a want or a need.

Real-World Scenarios

Take your kids shopping and turn it into a learning experience. Show them how to read labels, compare prices, and look for sales or discounts. Engage them in discussions about their purchasing decisions ask questions like, “Do you really need this?” or “Is there a less expensive option?”

Conclusion

By teaching these five money concepts understanding the value of money, saving versus spending, budgeting basics, the concept of interest, and smart spending—you’ll equip your children with the skills they need for financial independence. Start with small, relatable lessons and gradually introduce more complex ideas as they grow. The earlier they learn about money management, the more confident and capable they will be in handling their finances in the future. Investing time in these

Ready to empower your children with essential money skills? We encourage you to start teaching these five important concepts today! Begin with simple lessons and watch your kids grow into confident money managers. If you’re looking for personalized guidance on how to approach money management with your children or want to explore tailored financial planning strategies for your family, don’t hesitate to reach out. Schedule a free consultation call today, and let’s work together to secure a bright financial future for your kids!