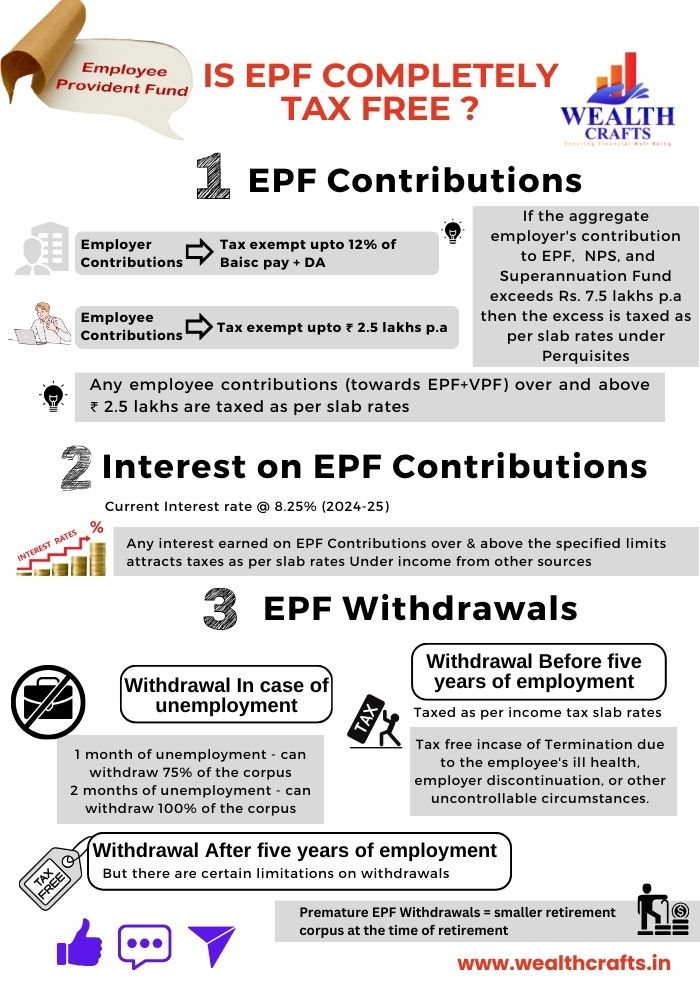

Is EPF Tax-free? Do you want to understand how your contributions and the growth it generates can be taxed? While one of the key attractions of EPF has been its tax benefits, is EPF tax-free completely?

EPF does maintain its “EEE(exempt-exempt-exempt)” status but with certain conditions. “EEE” means the contributions towards EPF are exempt from income tax at the time of investment, interest earned on the contributions is exempt from income tax, and the maturity amount is also exempted from income tax (up to a certain limit).

While Employee Provident Fund (EPF) stands as a pillar of financial security for salaried employees and offers a reliable avenue for building a nest egg for their retirement let us delve deeper into the taxation aspects of the Employee Provident Fund (EPF) to understand how it can pave the way to a comfortable retirement:

Navigating through the EPF Tax-Free status:

The Employee Provident Fund (EPF) stands as a tailored retirement benefits scheme for salaried employees. Under this scheme, both the employer and employee contribute towards the employee’s provident fund. Typically, the employee contributes approximately 12% of their basic salary along with dearness allowances, the employer matches this contribution equally. This mutual contribution structure ensures a systematic approach to building a robust retirement fund

The Central Board of Trustees (CBT), in collaboration with the Ministry of Finance, determines the interest rate for the Employee Provident Fund (EPF) annually. This interest rate remains applicable for each financial year, spanning from April 1st to March 31st. Interest accrues monthly and is credited to EPF accounts on March 31st each year.

The latest interest rate declared for 2024–25 for the Employee Provident Fund (EPF) stands at 8.25%.

Let us understand if the contributions, interest accruals, and withdrawals from EPF are Tax-free;

Employee Provident Fund Contributions :

Employer Contributions:

The employer’s contribution to the EPF tax-free up to a certain limit. However, if the aggregate employer’s contribution to the Employee Provident Fund (EPF), National Pension System (NPS), and Superannuation Fund exceeds ₹ 7.5 lakh in a financial year, the contribution and the interest/dividend earned on the excess amount are considered as perquisites in the hands of the employee for that year.

It becomes the employer’s responsibility to acknowledge this excess amount as a perquisite for the employee and withhold taxes accordingly

The employer’s contribution has the following categories:

| Category | Percentage of Contribution |

| Employees Provident Fund (EPF) | 3.67% |

| Employees’ Pension Scheme (EPS) | 8.33% |

| Employee’s Deposit Linked Insurance Scheme (EDLIS) | 0.50% |

• The initial segment of EPF (Employees Provident Fund) serves as the platform for accruing retirement benefits, constituting the wealth accumulation aspect of the scheme.

• The subsequent segment, EPS (Employee Pension Scheme), is designed to provide pension benefits to employees upon reaching the age of 58. Employers contribute 8.33% of the employee’s wages to the EPS, with a maximum cap of ₹ 1,250, while the remaining portion goes to the EPF.

Subsequently, the employer’s share contributed towards the Employee Pension Scheme (EPS) does not accrue interest. However, a member is eligible to receive his or her pension only after the age of 58, and the pension amount received post-retirement may not be substantial or inflation-adjusted.

• The concluding component of EPF is the Employee Deposit Linked Insurance Scheme, abbreviated as EDLI, offering life insurance coverage. The Employees’ Deposit Linked Insurance (EDLI) scheme, mandated by the Employees’ Provident Fund (EPF) Act, serves as a crucial life insurance benefit for employees.

In the unfortunate event of an employee’s demise during service, EDLI offers a lump sum payment to the nominee. This insurance coverage is directly linked to the EPF contributions made by the employer. Notably, the scheme ensures a minimum coverage amount of ₹ 2,50,000, with a maximum limit of ₹ 7,00,000.

As per the provisions of the EDLI, the contribution of an employer must be 0.5% of the basic salary or a maximum of ₹ 75 per employee per month. If there is no other group insurance scheme, the maximum contribution is capped at ₹ 15,000/- per month.

The convenience lies in the fact that there is no need for separate registrations to avail of these benefits. Enrolling in EPF automatically includes registration for EPS and EDLI as well.

Employee Contributions –

Employee Provident Fund (EPF) contributions are deductions made from an employee’s salary, and would be usually around 12% of the employee’s basic salary and dearness allowances. These contributions build a retirement corpus for the employee. Additionally, contributing to EPF offers a significant tax-saving opportunity.

Under Section 80C of the Income Tax Act, the amount contributed towards EPF is eligible for a tax deduction of up to ₹ 1.5 lakh per year. This deduction reduces taxable income, effectively lowering the tax liability for the contributor. Thus, EPF not only secures future financial stability but also provides valuable tax benefits.

Bridging the Gap: How Employees Can Enhance Retirement Savings with the Voluntary Provident Fund (VPF)

Employees have the option to bridge the gap when employers contribute less to the Employee Provident Fund (EPF) by opting for the Voluntary Provident Fund (VPF). Through VPF, employees can voluntarily increase their monthly PF contribution, with the ability to contribute up to 100% of the basic salary + DA. This excess contribution, however, is not matched by the employer beyond the mandated percentage of 12% of the basic salary + DA.

The amount contributed to VPF is credited to the same EPF account, with interest rates identical to EPF. This empowers employees to enhance their retirement savings by boosting their contributions. Additionally, contributions to VPF offer the same tax benefits as EPF under Section 80C of the Income Tax Act, facilitating effective tax planning.

Leveraging VPF enables employees to secure their financial future and ensure a comfortable retirement, especially in cases of inadequate employer contributions to the EPF.

How Employee Provident Fund (EPF) Contributions are Calculated?

Here is an example to illustrate the calculations –

Let us assume an employee’s basic salary is ₹ 30,000 per month and the DA is ₹ 7,500 per month.

Employee contribution:

12% of (₹ 30,000 + ₹ 7,500) = 12% of ₹ 37,500 = ₹ 4,500

Employer contribution:

12% of (₹ 30,000 + ₹ 7,500) = 12% of ₹ 37,500 = ₹ 4,500

Employee’s Provident Fund (EPF) – (3.67%) – ₹ 3,250

Employee’s Pension Scheme (EPS) – (8.33% of Basic Pay capped at ₹ 15,000 P.M) – ₹ 1,250

Employee’s Deposit Linked Insurance Scheme (EDLI’S) – (0.50% of Basic Pay capped at ₹ 15,000 P.M) – ₹ 75

So, in this case, the employee and employer would each contribute ₹ 4,500 towards the EPF account.

It is crucial to understand that EPF contributions are calculated based on the employee’s basic salary and dearness allowance (DA) and exclude other allowances or components of the salary.

Is Interest accumulation on EPF Tax-free?

Interest earned on EPF contributions is tax-exempt within specified limits. However, after April 1, 2021, any excess contributions exceeding Rs 2.5 lakh per year made by an employee to their EPF account, including the Voluntary Provident Fund (VPF), will incur taxable interest in the hands of the employee.

EPF Withdrawals Based on Duration of Employment

In case of unemployment

EPF balance can be withdrawn entirely in instances of retirement or unemployment exceeding two months. Under previous rules, a complete withdrawal was allowed for unemployment exceeding two months. However, under new rules in 2022, withdrawing the EPF balance while changing jobs without a two-month unemployment period is not permitted.

In cases of unemployment for two months, EPFO allows 100% withdrawal. Additionally, 75% of the corpus can be withdrawn after one month of unemployment, with the remaining 25% transferable to the new employer upon re-employment. However, this two-month waiting period for complete withdrawal does not apply to women who resign from their jobs due to marriage.

EPF withdrawal Before five years of employment

Withdrawals made before completing five years of service are taxable in the year of receipt, except in specific cases:

- Termination due to the employee’s ill health, employer discontinuation, or other uncontrollable circumstances.

- Transfer of PF account balance when changing employers, keeping the balance EPF tax-free.

Withdrawals less than Rs. 50,000 before five years of service are taxable based on the individual’s tax slab rate. Withdrawals exceeding Rs. 50,000 before five years of service are taxed as per slab rates and are subject to TDS. 10% TDS with PAN, or the maximum marginal tax rate without PAN. Submission of Form 15G/15H exempts TDS.

Early Withdrawals from EPF Tax-free after 5 years of employment;

Withdrawals after completing five years of consecutive service are tax-free in the year of receipt. EPF early withdrawals involve accessing funds from the Employees’ Provident Fund (EPF) before the retirement age of 58. These withdrawals are permitted for specific purposes like medical emergencies, education expenses, home loans, or marriage.

However, meeting certain conditions and criteria is necessary, and withdrawal amounts may be subject to EPF-set limits. It is crucial to grasp the impact of early withdrawals on retirement savings. While they offer immediate financial relief, they can significantly affect long-term savings growth. Thus, careful consideration of necessity and consequences is vital before opting for early withdrawals.

For detailed withdrawal information, click on the below link – https://www.epfindia.gov.in/site_docs/PDFs/Downloads_PDFs/TypesOfAdvances_Form31.pdf

The Impact of Premature EPF Withdrawals on Long-Term Financial Security

The EPF tax-free early withdrawals after 5 years of employment can significantly impede the accumulation of the retirement corpus. By withdrawing funds prematurely, individuals diminish the principal amount available for investment, thereby reducing the potential for compounding growth over time. This reduction in the principal amount directly translates to a smaller retirement corpus at the time of retirement.

Furthermore, early withdrawals disrupt the long-term financial planning process, making it harder to achieve retirement goals. The compounding effect, which is essential for wealth accumulation, is lost when funds are withdrawn early, leading to a missed opportunity for substantial growth.

What happens to EPF when you retire or when there are no further contributions to EPF?

If there are no contributions to the Employee Provident Fund account for three consecutive years, it becomes inactive or dormant. Interest continues to be paid on the EPF account until the employee retires, but it is taxable based on the employee’s tax slab rate.

However, once the account is inoperative (i.e., no contributions received for three years after the retirement age of 55, permanent migration abroad, or in case of death), no interest accrues from there on. If the account remains inactive for seven years without any claims, the funds are transferred to the Senior Citizen Welfare Fund by the EPF.

Feeling overwhelmed by the intricacies of the EPF tax-free benefits or unsure if you are maximizing its potential? Do not navigate your retirement savings alone! As a financial planner, we can help you understand your options, optimize your contributions, and ensure your EPF is working as hard as you are. Schedule a free introductory call today to discuss your situation and unlock the full potential of your retirement savings. Let us work together to secure your financial future!