Thinking of buying your dream house? It signifies stability, security, and a place to build a life. But with a complex market and ever-changing factors, navigating the ideal time to buy your dream house can feel overwhelming. The decision to buy your dream house in India is a significant milestone for many individuals and families. However, timing plays a crucial role in this decision-making process.

Understanding when the right time to buy your dream house and the factors influencing this decision is essential to make a well-informed choice. In this blog, we will explore the optimal timing to buy your dream house and the key factors that prospective buyers should consider. Fear not! This blog will guide you through the intricacies of the Indian housing market, helping you determine the perfect time for your dream purchase.

4 factors Determining the Right Time to Buy Your Dream House:

Buying a house involves considering various economic, financial, and personal factors. While there’s no one-size-fits-all answer, certain indicators can help prospective buyers make an informed decision.

Economic Conditions:

Economic stability and growth are pivotal factors influencing the real estate market. During periods of economic growth and low inflation, property prices tend to rise steadily. Conversely, economic downturns may lead to stagnant or declining property values. Monitoring economic indicators such as GDP growth, inflation rates, and employment trends can provide insights into the overall health of the real estate market.

Interest Rates:

The prevailing interest rates on home loans significantly impact the affordability of purchasing a house. Lower interest rates translate to lower monthly mortgage payments, making homeownership more affordable. Prospective buyers should keep an eye on interest rate trends and consider locking in a favourable rate when purchasing a house.

Real Estate Market Trends:

Monitoring real estate market trends at both national and local levels is crucial for timing the purchase of a house. Factors such as supply and demand dynamics, inventory levels, and price trends in specific neighbourhoods or cities can influence the decision-making process. Buyers should conduct thorough research and consult real estate experts to gauge market conditions accurately. Research historical data and consult with real estate experts to gauge potential price movements. The Indian market experiences cyclical ups and downs. Buying during a stable or downward phase might be advantageous. However, prioritize your needs over timing the market perfectly. The right property at the right price, even in a slightly inflated market, can still be a good investment.

Personal Financial Situation:

Assessing one’s financial readiness to buy your dream house is essential. Prospective buyers should evaluate their income stability, savings, credit score, and debt-to-income ratio. Additionally, considering long-term financial goals and budgeting for homeownership-related expenses such as down payments, closing costs, property taxes, and maintenance is crucial.

There’s No Magic Formula: Personal Finances Take Center Stage

While external factors play a role, the most crucial consideration is your financial readiness.

3 Key Personal aspects to assess before you buy your dream house:

Job Security:

Buying a house is a long-term commitment. A stable income source is crucial to ensure you can consistently make your loan payments over time. It is advised to Buy a house later in your career once you have the job stability and are sure about the location.

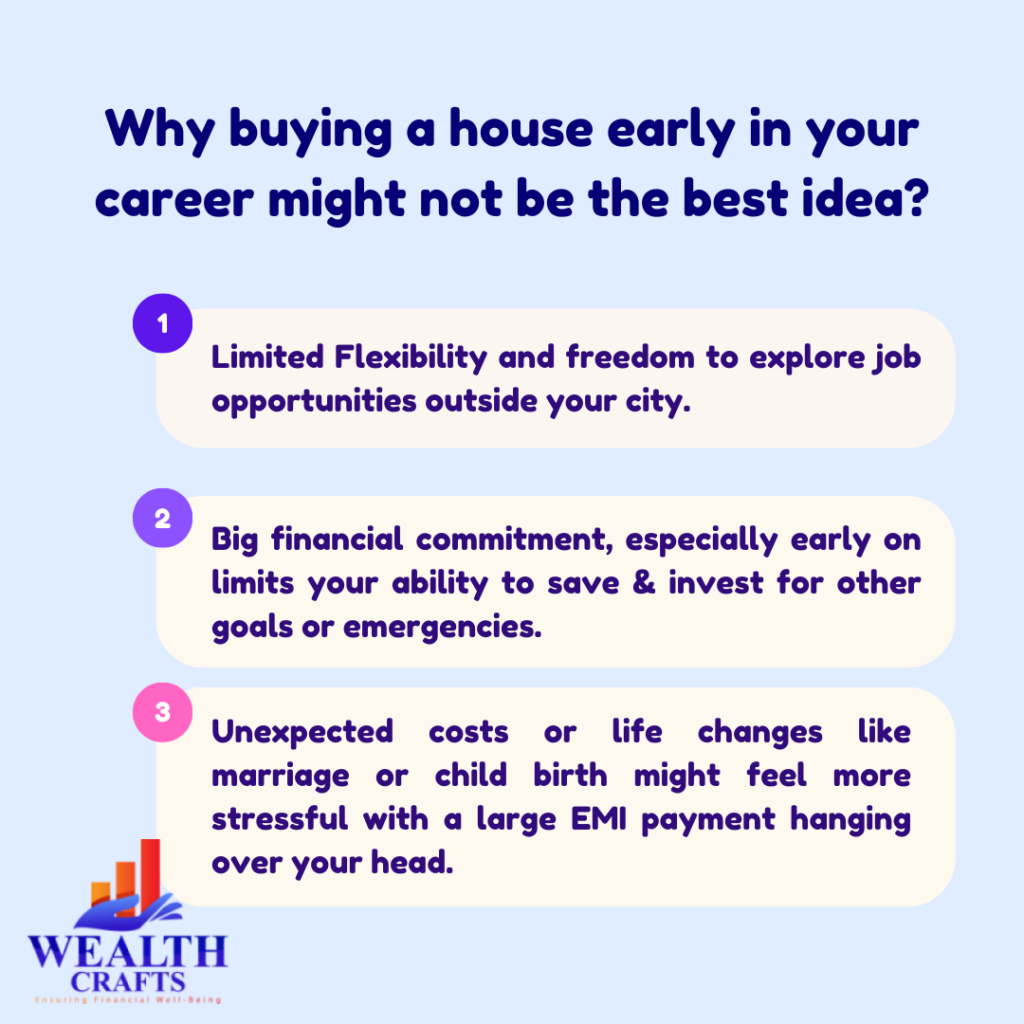

Why buying a house early in your career might not be the best idea?

Limited Flexibility and freedom: Early careers are often about exploration. You might want to travel for work assignments, consider job opportunities in different cities, or even pursue further education. Owning a house makes such transitions much more complex. You’d be tied down to a specific location, potentially missing out on valuable growth opportunities.

Invest in your career first. Gain experience and stability, which will increase your earning potential and make you a stronger loan applicant later.

Stable Income and Savings:

Can you comfortably afford the down payment and monthly loan EMIs (Equated Monthly Installments)? A healthy down payment (ideally 40% or more) reduces your loan burden and interest cost. Home loan EMIs (Equated Monthly Instalments) can be a big financial commitment, especially early on. This can limit your ability to save and invest for other goals or emergencies.

Debt Management:

Existing debts like credit cards or personal loans can make it harder to qualify for a home loan or put a strain on your finances after buying. Unexpected costs or life changes might feel more stressful with a large EMI payment hanging over your head.

Clearing or minimizing them before a home loan application strengthens your financial standing. A good rule of thumb is to keep your total EMIs (including your potential home loan) to under 25% of your take-home pay.

Opt for Home laon provider who can offer you an overdraft facility on the home loan, which can help you reduce the cummulative interest cost by parking the emergency fund in the overdraft facility. Read more about Home loan overdraft facility here

If the EMI’s are crossing 25%, it is advised to explore renting options that suit your lifestyle and work on increase your income alternatively for few more years. You might find a flexible lease or a shared living situation that allows for more freedom. While renting, focus on building a healthy down payment. This will reduce your loan amount and monthly payments when you are ready to buy.

6 Factors to Consider Before you buy your dream house:

Apart from timing considerations, several factors merit careful evaluation before purchasing a house in India.

Location, Location, Location:

The location of the property is one of the most critical factors to consider. Factors such as proximity to workplaces, schools, healthcare facilities, public transportation, and recreational amenities influence both the quality of life and the property’s resale value. Buyers should assess the neighborhood’s infrastructure, safety, and future development plans before making a decision.

Budget and Affordability:

Setting a realistic budget and determining affordability is imperative. Buyers should consider not only the purchase price of the property but also additional costs such as registration fees, stamp duty, legal expenses, interior and maintenance costs. It’s essential to strike a balance between affordability and the desired features or amenities in a property.

Property Type and Size:

Deciding on the type and size of the property depends on individual preferences, lifestyle, and family size. Whether opting for an apartment, villa, or independent house, buyers should consider factors such as floor plan, layout, number of bedrooms and bathrooms, parking facilities, and available open spaces.

Legal Due Diligence:

Conducting thorough legal due diligence is critical to avoid potential disputes or complications post-purchase. Buyers should verify the property’s ownership status, title deeds, land records, and encumbrances. Consulting with legal experts and obtaining a clear title certificate is advisable to ensure a smooth and hassle-free transaction.

RERA Verification:

RERA verification is a crucial step when buying a house in India. RERA, or the Real Estate (Regulation and Development) Act, 2016, mandates that all real estate projects must be registered under the authority. This verification ensures transparency, and accountability, and protects buyers from fraudulent practices. Prospective buyers should check the RERA registration status of the project and the developer before making any commitments. It assures the legality and authenticity of the property transaction, offering peace of mind to buyers.

Builder/Developer Reputation:

When purchasing a property from a builder or developer, evaluating their reputation, track record, and credibility is essential. Researching the builder’s past projects, quality of construction, adherence to timelines, and customer reviews can provide valuable insights into their reliability and trustworthiness.

Remember, There’s No One-Size-Fits-All

The “right time” to buy a house depends on your unique circumstances, financial situation, and life goals. Don’t get caught up in the pressure to buy during a specific period.

6 additional tips to buy your dream house:

- Be Patient: Finding the perfect property might take time. Don’t rush into a decision.

- Maintain a Good Credit Score: A higher credit score qualifies you for better loan terms.

- Plan for Long-Term Ownership: Buying a house is a long-term commitment. Consider factors like potential maintenance costs and future resale value.

- Inspection is Key: A thorough property inspection uncovers potential structural issues, electrical problems, or hidden repairs needed. Factor in renovation costs if necessary.

- Negotiation is an Art: Don’t be afraid to negotiate the price based on your research and the property’s condition. Consult a real estate agent who can guide you through the process, identify suitable properties, and handle negotiations.

- Don’t Forget the Festive Season: Many Indians consider the festive season (Diwali) auspicious for property purchases. Developers might offer special deals or discounts during this period.

Buying a house in India is a significant financial decision that requires careful consideration of various factors, including timing, economic conditions, personal finances, location, property type, legal aspects, and builder reputation. By prioritizing your financial readiness, conducting thorough research, and seeking professional guidance, prospective buyers can make confident and well-informed choices that align with their preferences and financial goals.

Remember, the perfect time to buy your dream house is when you’re financially prepared and have found a property that aligns with your needs and aspirations. With careful planning and the right guidance, your dream home can soon become a reality. For personalized financial advice tailored to your situation, consult with our professional financial planner who can help you navigate the complexities of home buying and plan for a secure financial future.