Parents can use minor account to invest for their children’s goals. Securing your child’s future is a top priority for every parent. This allows you to grow a dedicated fund for their education, marriage, or other future needs. But how do you get started?

Let’s uncover what minor accounts are, their benefits and drawbacks, and how to get started on your child’s investment journey. We’ll also explore the diverse investment options available to secure your child’s financial future.

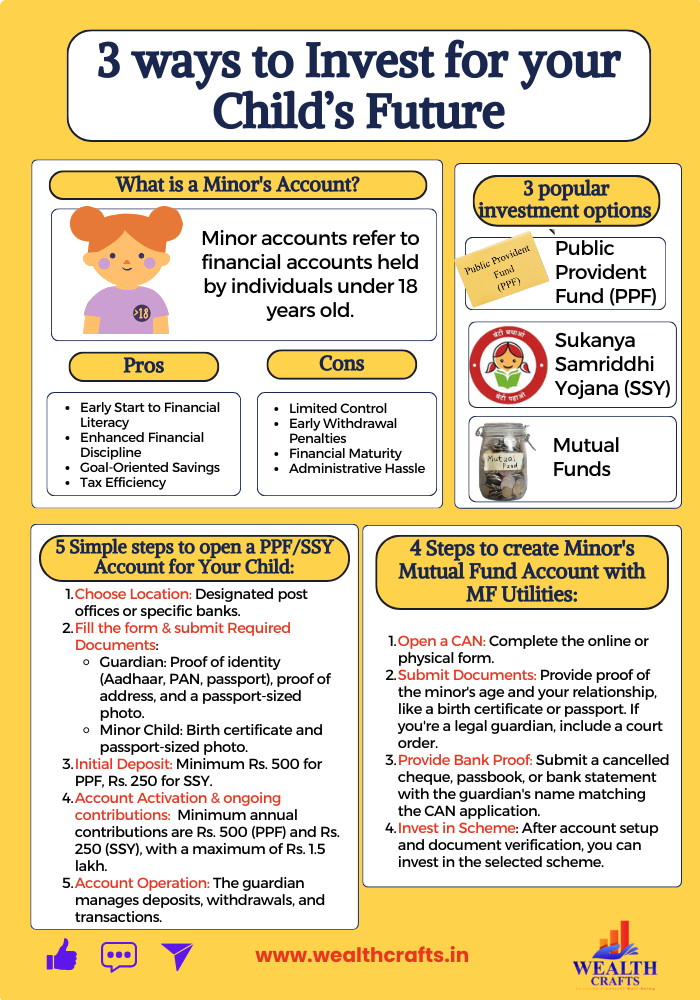

What is a Minor’s Account?

Financial accounts in the name of individuals who are less than 18 years of age are labelled as minor accounts. This account is usually managed by a guardian, who can make financial decisions on behalf of the minor.

Pros and Cons of Investing in a Minor Account

Pros:

- Early Start to Financial Literacy: Early exposure to savings and investments can instil good financial habits in children. Children can learn how their money can grow over time through the magic of compound interest.

- Enhanced Financial Discipline: Investing in a minor’s name can instill a sense of responsibility and financial discipline in parents or guardians. Parents often view investments in their child’s name as a sacred trust, earmarked specifically for their education or other significant life milestones. This emotional connection can deter them from dipping into these funds, even in times of financial hardship, ensuring the money remains untouched until it’s truly needed.

- Goal-Oriented Savings: A minor’s account can be earmarked for specific goals like higher education or marriage expenses. This dedicated fund can motivate parents to consistently invest towards their child’s future.

- Tax Efficiency: Until the child turns 18, capital gains from mutual fund investments are taxed at the parent’s or guardian’s tax rate. Once the child turns 18, they may be in a lower income tax bracket. This can result in a significantly lower tax liability on their investment earnings. For instance, if the child’s total income, including capital gains, falls below the basic exemption limit, no tax will be levied.

Cons:

- Limited Control: “Once the child turns a major the child would have full control of the funds in the minors account and may not realise the importance of managing the funds for the designated purpose like education or marriage that the parents had envisioned and they could risk misappropriation of the fund saved for these goals by the children”

- Early Withdrawal Penalties: Many investment products, especially those designed for long-term growth, have penalties for early withdrawals. This can impact the overall returns and the ability to access funds when needed, especially in unforeseen circumstances.

- Financial Maturity: While investing early can instil financial discipline. Parents should spend considerable time educating their children on basic money management skills so that when the children become major and get control of the funds they utilise the funds and manage them in a different way.

- Administrative Hassle: Transitioning the account from a minor’s to a major’s name can be a complex process involving paperwork, legal formalities, and potential tax implications. This can be time-consuming and stressful, especially if not handled properly.

3 popular investment options to Invest for Your Child;

Public Provident Fund (PPF):

Public Provident Fund (PPF) is a long-term investment option offered by the Government of India. It’s a popular choice for parents looking to secure their child’s financial future due to its tax benefits and stable returns. Refer our blog to know more about PPF

Sukanya Samriddhi Yojana (SSY):

The Sukanya Samriddhi Yojana (SSY) is a government-backed savings scheme specifically designed for the future of girl child. This offers higher interest rates compared to other savings schemes along with Tax benefits under Section 80C.Refer our blog to know more about SSY

5 Simple steps to open a PPF/SSY Account for Your Child:

To open a PPF or SSY account for your child, you’ll need to be a legal guardian. Here’s a general guide:

- Choose an Account Opening Location: You can open a PPF/SSY account at designated post offices or specific banks.

- Required Documents: Fill up the PPF/SSY opening form and submit the necessary documents. For the Guardian: Proof of identity (Aadhaar card, PAN card, passport, etc.) ,Proof of address (Aadhaar card, passport, driving license, etc.) and Passport-sized photograph. For the Minor Child: Birth certificate and Passport-sized photograph

- Make the Initial Deposit: A minimum initial deposit of Rs. 500 is required for PPF and it is Rs. 250 for SSY.

- Account Activation: Once the application is processed and verified, the account will be activated. You can make a minimum annual contribution of Rs. 500(PPF) & Rs. 250 (SSY) and a maximum of Rs. 1.5 lakh.

- Account Operation: As the guardian, you’ll be responsible for making deposits, withdrawals, and other account-related transactions.

Note: Specific procedures and documentation requirements may vary across banks and post offices. It’s advisable to check with your chosen institution for the latest information.

Mutual Funds:

Mutual Funds offer a diverse range of investment options tailored to various risk profiles and financial objectives. They have the potential to generate higher returns than traditional savings accounts like PPF & SSY and ensure liquidity. Through Systematic Investment Plans (SIPs), you can invest regularly and systematically. Mutual funds are ideal for long-term wealth creation and achieving your children’s education, marriage or retirement goals.

4 Steps in Creating a Minor account with MF Utilities to invest Mutual Fund Account :

To create a minor account with MF Utilities, you’ll need to follow these steps:

- Open a CAN (Client Account Number): Open a CAN instantly online or fill out a physical form. Ensure the minor’s name is correctly mentioned as the account holder.

- Submit Required Documents: You will need to provide documents to prove the minor’s age and your relationship with them. Acceptable documents include: Birth certificate, Passport copy & Mark sheet or leaving certificate from the HSC board of respective states, ICSE, CBSE, etc. In case of Legal Guardian, A copy of the court order appointing the guardian is necessary.

- Provide Minor Bank a/c Proof: Provide a cancelled cheque, bank passbook, or bank statement with the guardian’s name. Ensure the guardian’s name on the bank proof matches the name on the CAN application form.

- Invest in the chosen scheme: Once the account is set up and all documents are verified, you can invest in the chosen scheme.

Important Considerations for Minor Accounts:

Sole Ownership: The minor is the sole owner of the account.

Guardian’s Role: The guardian, whether a natural guardian (parent) or a court-appointed legal guardian, will manage the account on the minor’s behalf.

Fund Additions and Withdrawals: Funds can be added to the account from the minor’s bank account, a joint account with a guardian, or the guardian’s individual bank account. Withdrawals can be made to the minor’s registered bank account or a joint account with the guardian.

Change in status on minor attaining majority:

Once a minor reaches the age of majority, they must submit a Minor to Major (MAM) form along with necessary documents to change their account status. From this point on, the guardian will no longer be able to perform any financial or non-financial transactions on the account. Any existing standing instructions like SIP, SWP, or STP that extend beyond the minor’s majority date will be automatically cancelled. Essentially, the minor’s account will be frozen until the status change is completed.

Requirements for Changing Status from Minor to Major

Before submitting the Minor to Major (MAM) form, the individual who has turned 18 must:

- Obtain a PAN Card: Apply for and receive a PAN card.

- Complete KYC: Undergo the Know Your Customer (KYC) process.

- Update Bank Account: Change the status of their existing bank account to ‘Major’ or open a new bank account with their name pre-printed on the chequebook.

Required Documents for the MAM Form:

- Duly Filled MAM Form: The form must be signed and attested by a parent/guardian, Notary, or Judicial Magistrate First Class (JMFC). Alternatively, the signature can be attested by the respective banker.

- PAN Card: A copy of the individual’s PAN card.

- KYC Acknowledgment or Form: Proof of completing the KYC process.

- Bank Proof: A cancelled cheque leaf or a recent bank statement/passbook with the individual’s name.

- Signature Attestation: If the signature on the MAM form is not attested by a guardian, Notary, or JMFC, a signature attestation by a banker is required.

- Nomination Form: A completed nomination form.

- New Standing Instructions: If the individual wishes to continue with SIP, STP, or SWP, they must submit new mandates in the prescribed format.

By following these steps and keeping the above considerations in mind, you can successfully set up a minor account and start investing for their future.

Ready to start investing for your child’s future? By opening a minor account and choosing the right investment options, you can set them up for financial success. While investing in a minor’s name offers numerous benefits, it’s essential to consider the potential drawbacks and make informed decisions.

Consult with a financial advisor to tailor an investment strategy that aligns with your child’s specific needs and your family’s financial goals. Spread your investments across different asset classes to manage risk. Monitor your investments regularly and rebalance your portfolio as needed.